Navigating the intricate world of finance can be a challenge. Yet, it’s essential to understand elements like credit defaults, how long they stay on file, and their implications on your financial well-being. This article delves into the surprising reality of ‘How Long Do Credit Defaults Stay on File?’ and empowers you to manage your credit history effectively.

What is a Credit Default?

A credit default is a negative mark that appears on your credit report when you fail to keep up with your loan, mortgage, or credit card payments for a significant period, usually six months. Default notices are a lender’s way of flagging a borrower’s failure to adhere to the terms of their credit agreement, a serious issue that can heavily impact your credit score.

Consequences of a Credit Default

When a default is listed on your credit file, it becomes visible to future lenders, credit reference agencies, and in some cases, employers. The presence of a default signals potential financial distress, which can make lenders wary of extending credit.

Not only does it hinder your ability to secure new loans or credit cards, but it may also affect interest rates offered, leading to potentially higher costs. In some cases, it may even impact your job applications, particularly in the finance sector.

How Long Do Credit Defaults Stay on File?

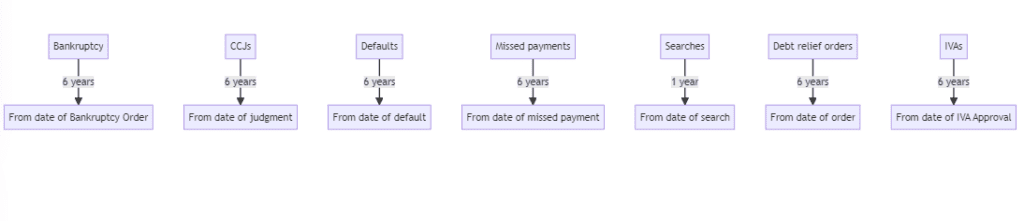

Under the Consumer Credit Act applicable in England & Wales, a credit default will stay on your credit file for six years from the date of default, irrespective of whether the debt has been paid off. This period applies even if you enter a debt relief order or declare bankruptcy.

Your credit file holds information about your financial behaviour over the past six years. So, if you’ve received a default notice, it’s critical to start considering steps towards improving your credit health.

The below diagram shows how long various adverts events have an impact on your credit score:

How Does a Default Compare to a CCJ?

A default and a County Court Judgement (CCJ) are both negative marks on your credit file, but they’re not the same. A default occurs when you miss payments, whereas a CCJ is a type of court order in England & Wales that a creditor can file if you fail to repay a debt.

As a rule, a CCJ is considered worse than a default. The reason being, it demonstrates that the borrower has not only missed payments but has also failed to respond to court action.

The Impact of Defaults on Major Financial Decisions

Defaults have a substantial impact on major financial decisions and can influence your ability to access important financial products. This is due to the negative impression they leave on your credit report, causing lenders to view you as a high-risk borrower.

Default and Mortgage Applications

One of the most significant areas impacted by defaults is securing a mortgage. When applying for a mortgage, lenders undertake a thorough check of your credit history to determine whether you are a reliable borrower. A default on your credit file can be a red flag to mortgage lenders, who fear the risk of non-payment. This could lead to the rejection of your mortgage application, or you might be subjected to higher interest rates due to the perceived risk.

Additionally, a default can indirectly impact the size of the mortgage you can secure. This is because the higher interest rates you’re charged due to a default can reduce the amount you can afford to borrow. This can affect your ability to purchase the property you desire.

Settled Versus Unsettled Defaults

There is a difference between a settled default and an unsettled one when it comes to the eyes of lenders. A settled default indicates that you’ve acknowledged the debt and have taken steps to repay it. This shows potential lenders that you have taken responsibility for your debt and are less likely to default on future obligations.

However, it’s important to note that while settling a default improves your standing, it doesn’t erase the default from your credit report. The default will stay on your file for six years, but a note will be added to indicate that it’s been paid.

This can still influence lenders’ decisions, but they may be more inclined to consider your application. They will look at the overall pattern of your credit behaviour, and a settled default shows a commitment to addressing your financial difficulties.

It’s worth noting, however, that different lenders have different policies. Some might ignore defaults after a certain number of years, while others may consider more recent financial behaviour as more important. Therefore, it is beneficial to maintain an open dialogue with potential lenders to understand their criteria.

The Long-lasting Effects of Defaults

Although defaults are automatically removed from your credit file after six years, the implications can last longer. If you have a default, it can make future financial planning more complex and demanding, particularly if you’re planning on making significant financial decisions like buying a house or car.

Overall, the impact of defaults on major financial decisions is profound. If possible, try to avoid defaulting on any credit agreement. If you’re struggling with debt, it’s important to seek professional advice from a reliable source such as a debt charity or financial advisor who can help you manage your situation.

Managing and Mitigating the Impact of Credit Defaults

Despite the negative impact of a default, remember that your financial past doesn’t need to dictate your future. Here are some steps you can take:

- Arrange a repayment plan with your creditor: This step shows future lenders that you’re committed to resolving your debt.

- Maintain a good credit relationship elsewhere: Make sure all other debts or bills are paid on time to improve your overall credit score.

- Review your credit report regularly: Check for errors and dispute them if necessary. Also, ensure that the default is removed from your file after six years. If you find any errors on your file, you should initially refer to the relevant creditor. If you have no success, you can then contact the credit reference agency such as Experian, Equifax or Transunion to attempt to resolve the situation.

Seeking Professional Help

Facing credit defaults can be overwhelming, but you’re not alone. Charitable organisations and debt advice services such as Money Helper offer free debt help, guiding you through debt management strategies, defaults, CCJs, and much more. They can provide personalised advice based on your financial circumstances, helping you navigate through this difficult period.

If you are concerned about defaults on your file and the inability to repay your debts when they fall due, please contact us here at Become Debt Free today and speak with one of our professional advisors to assess what options are best suited to your needs. Whether that be an Individual Voluntary Arrangement, Bankruptcy or a Debt Relief Order or other solution, we can advise you of all the options.

Conclusion

Understanding ‘How Long Do Credit Defaults Stay on File?’ is the first step towards better managing your financial future. Although the road might seem challenging, with careful planning, timely action, and professional help when needed, you can navigate towards a brighter financial future. Remember, your past doesn’t dictate your financial future, but how you respond to it can shape the course of your financial health.

If you are concerned about defaults on your file and the inability to repay your debts when they fall due, please contact us here at Become Debt Free today and speak with one of our professional advisors to assess what options are best suited to your needs. Whether that be an Individual Voluntary Arrangement, Bankruptcy or a Debt Relief Order or other solution, we can advise you of all the options.

FAQs

Will paying off a defaulted account remove it from my credit report?

Paying off a defaulted account does not automatically remove it from your credit report. The default will still be visible for the specified duration, but your efforts to repay the debt can positively impact your creditworthiness.

Will multiple defaults have a greater impact on my credit score?

Multiple defaults can have a cumulative negative effect on your credit score. Lenders may view this as an indication of increased risk, which can make it more difficult to secure new credit or loans. However, responsible financial behaviour over time can help mitigate these effects.

Is a default a CCJ?

No, a default and a County Court Judgement (CCJ) are not the same. A default is a mark that a lender puts on your credit file if you’ve failed to maintain your contractual monthly repayments, typically after three to six missed payments. A CCJ, on the other hand, is a type of court order in England, Wales, and Northern Ireland that might be registered against you if you fail to repay money you owe. This is typically a step a creditor takes after defaults and several attempts to recover the owed money have failed.

Is a CCJ worse than a default?

In terms of credit scoring, yes, a CCJ is considered worse than a default. Both will have a significant negative impact on your credit score and ability to obtain credit, but a CCJ carries more weight as it’s a court judgement against you for non-payment of debt. It signifies to future lenders that a court had to intervene to facilitate repayment, implying a more severe level of debt delinquency.

Can I get a mortgage with a default?

Yes, it is possible to get a mortgage with a default on your credit file, but it can be more challenging. High street lenders may decline an application with recent defaults, but some specialist or subprime lenders might consider your application. It largely depends on the circumstances around your defaults, such as their age, the amount of money involved, whether they’re satisfied and the frequency of these incidents. A larger deposit may also be required, and interest rates might be higher. Professional advice from a mortgage broker can be beneficial in such situations.

Is a settled default better than a default?

A settled default is indeed viewed more favourably than an unsettled default. When a default is marked as settled, it means you’ve paid off the debt in question. While the default will still remain on your credit file for six years, lenders may look more favourably on your application if they see that you have made an effort to clear your debts. However, a settled default will not remove the default notice. The best course of action is to avoid a default in the first place by maintaining regular contact with your creditors and seeking free debt help if necessary.

References

The primary sources for this article are listed below.

Free and impartial help with money, backed by the government | MoneyHelper

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.