Uncover the surprising truth about ‘how long does a default last’. Dive into our guide for insights on defaults and strategies to regain your financial control. Don’t let late payments on defaulted accounts control your financial future – get informed today with free debt help!

Quick Links

- What is a Default?

- Default Process

- How Long Do Defaults Stay on Your Credit Report?

- Default Notices and Their Effect on Your Credit File

- Minimizing the Negative Impact of Defaults on Your Credit Score

- Exploring the Duration of Defaults on Credit Reports

- Mortgage Eligibility and Defaults: Potential Obstacles

- Taking Control of Your Credit Report and Debt Management

- Frequently Asked Questions

- References

What is a Default?

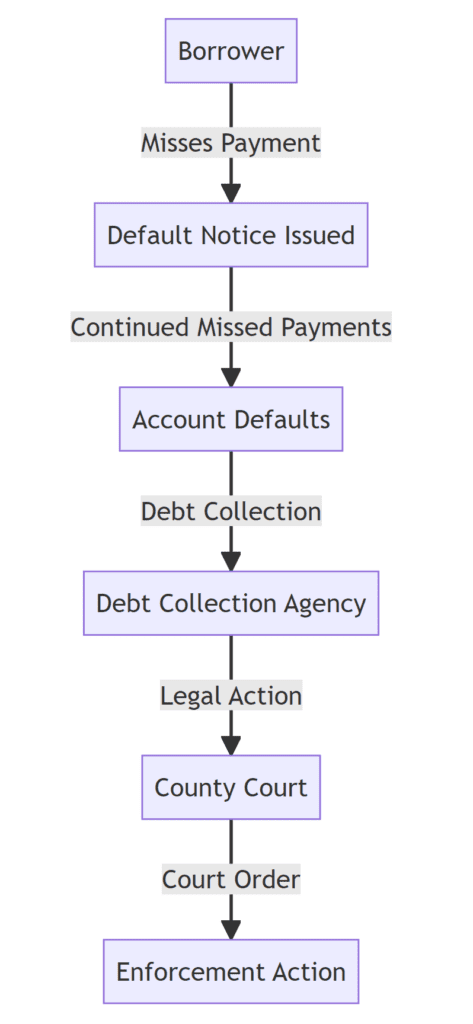

A default, in the context of credit, is a status that gets assigned to an account when a borrower fails to meet the terms of their credit agreement. It typically occurs when a borrower has missed several payments consecutively, indicating a severe level of financial distress.

When you borrow money, you enter into a contract with the creditor, agreeing to make regular repayments until the debt is fully repaid. This agreement can be for various forms of credit, such as a credit card, loan, or mortgage. If you fail to make the agreed payments on time, you are said to be in ‘default’ of your credit agreement. This can negatively impact your financial history and may lead to bankruptcy.

The process leading to a default usually begins with one missed payment, which can negatively impact your credit record and credit scores. However, most lenders won’t declare an account in default after just one missed payment. They will often allow for a grace period, during which you can make up the missed payment without any severe consequences for late payments or bad credit.

If you continue to miss payments beyond this grace period, the lender will typically send a series of reminders or warnings, often in the form of default notices. These notices will inform you of the missed payments and the potential consequences if the situation is not rectified. Credit reference agencies could also be notified and this, in turn, could affect your credit score.

Default Process

How Long Do Defaults Stay on Your Credit Report?

In the United Kingdom, a default will stay on your credit report for six years from the date it was recorded, regardless of whether you have paid off the debt in the meantime. This six-year period is stipulated by the UK’s credit reference agencies – Experian, Equifax, and TransUnion – and applies even if you settle the account by paying the full amount owed or reach an agreement with the lender to pay a reduced amount.

The six-year period for a fresh start is based on the principle that it is reasonable to allow individuals with a bankruptcy on their credit record to rebuild their credit scores and credit rating. This time frame is also in line with the Limitation Act 1980, which sets a six-year limit for lenders to pursue most types of debt.

It’s important to note that the six-year period for your credit record starts from the date of the default, not from when the account was opened or when any missed payments occurred. If you continue to miss payments without any arrangement with the lender, your credit rating will be marked as in default, and the six-year period for your credit file will begin.

The account defaults will remain on your credit report for six years, even if you start making payments again or pay off the debt in full. However, the record of the account defaults will be updated to show that you have paid off the debt, which can be viewed positively by lenders.

Once the six years have passed, the missed payment and account defaults will be automatically removed from your credit report. This removal happens even if you haven’t fully paid off the debt. However, it’s important to understand that while the record of the missed payment and account defaults is removed from your credit report, the debt itself is not necessarily written off and the lender can still legally pursue you for it.

Default Notices and Their Effect on Your Credit File

A default notice is a formal letter sent by your lender or creditor when you fail to make the agreed repayments on your credit agreement. It’s a crucial part of the process that lenders must follow before marking your credit file with a default. The default notice is governed by the Consumer Credit Act 1974 and serves as a warning that your account is on the verge of being defaulted.

The default notice will detail the following:

- The nature of the agreement you have breached (for example, a credit card agreement or a loan agreement).

- The terms and conditions you have failed to comply with may impact your credit file and credit record, including the default date.

- The action you need to take to remedy the breach.

- The deadline for taking this action, which is typically 14 days from the date of the notice.

If you fail to respond to the default notice or cannot clear the arrears within the stipulated time, the lender can register a default on your credit file. This default is a significant negative mark and will likely lower your credit score.

As stated above, the impact of a default notice on your credit file is substantial. Once a default is recorded, it will remain on your credit file for six years from the date of default, regardless of whether you subsequently pay off the debt. During this period, the default can affect your ability to obtain further credit. Lenders view defaults as evidence of past financial difficulties, which can make them hesitant to lend to you, or they may offer you credit at higher interest rates.

However, if you’re able to pay off your debt or reach an agreement with your lender within the timeframe specified in the default notice, the default may not be recorded on your credit file. This is why it’s crucial to act promptly when you receive a default notice.

Minimizing the Negative Impact of Defaults on Your Credit Score

Defaults can have a significant negative impact on your credit score, making it more difficult to obtain credit in the future. However, there are strategies you can employ to manage and reduce the impact of defaults on your credit score. Let’s explore these strategies and the importance of proactive debt management.

Pay Off Outstanding Debts

The first step in minimizing the impact of defaults is to pay off any outstanding debts associated with the default. While the default will remain on your credit report for six years, lenders may view your situation more favourably if they see you’ve taken steps to resolve the issue.

Set Up a Repayment Plan

If you’re unable to pay off the entire debt at once, consider setting up a repayment plan with your creditor. This shows that you’re taking responsibility for the debt and making an effort to pay it back. Be sure to set up a plan that’s realistic for your financial situation to avoid missing any further payments.

Check Your Credit Report Regularly

Regularly checking your credit report can help you stay on top of any changes and spot any potential errors. If a default has been recorded incorrectly, you can challenge it and potentially have it removed from your report.

Build a Positive Credit History

While you can’t erase a default, you can work on building a positive credit history to help offset its impact. This can include making all your other credit payments on time, not using too much of your available credit, and not applying for too much new credit at once.

Seek Professional Advice

If you’re struggling with debt, it may be helpful to seek advice from a professional debt advisor. They can provide guidance on managing your debts and dealing with defaults.

Proactive debt management is crucial in minimizing the impact of defaults on your credit score. By taking control of your financial situation and making a plan to deal with defaults, you can start to repair your credit and improve your financial future. Remember, a default doesn’t have to control your financial life forever. With the right strategies and support, you can navigate through this challenging situation and work towards a more secure financial future.

Exploring the Duration of Defaults on Credit Reports

When it comes to understanding the impact of defaults on your credit report, one of the most critical factors to consider is the duration of these defaults. The lifespan of defaults on credit reports can significantly influence your ability to secure credit, and different circumstances can affect this duration. Let’s delve deeper into this topic.

How Long Does a Default Last?

In the UK, a default will stay on your credit report for six years from the date of default, regardless of whether you’ve paid off the debt. This duration is standard and applies to most types of debt, including credit cards, loans, and utility bills. After six years, the default is automatically removed from your credit report.

Early Settlement and Its Impact

If you settle the debt earlier, the default’s status will be marked as ‘satisfied’, but it will still remain on your credit report for the six-year period. However, lenders may look more favourably upon a satisfied default than an outstanding one when assessing your creditworthiness.

The Role of Individual Credit Reference Agencies

It’s worth noting that different credit reference agencies may record information slightly differently. For instance, if you pay off a defaulted debt, some agencies may show the default as being settled, while others may remove the default notice from your report.

The Impact of Serious Financial Issues

More serious financial issues, such as bankruptcies or Individual Voluntary Arrangements (IVAs), can also affect the duration of defaults on your credit report. These issues are typically recorded on your credit report for six years as well. However, if your bankruptcy or IVA lasts longer than six years, it will stay on your report for longer.

The Effect of Multiple Defaults

If you have multiple defaults on your credit report, each default will be recorded separately and will remain on your report for six years from their respective default dates. This means that a later default could still be affecting your credit score even after an earlier one has been removed.

Mortgage Eligibility and Defaults: Potential Obstacles

Navigating the mortgage application process can be challenging, and having defaults on your credit report can add an extra layer of complexity. Defaults can indeed affect your eligibility for a mortgage, but it’s not an insurmountable obstacle. With the right approach and understanding, you can still secure a mortgage despite having defaults. Let’s explore how.

The Impact of Defaults on Mortgage Eligibility

When you apply for a mortgage, lenders will conduct a thorough credit check to assess your financial reliability. Defaults on your credit report can be a red flag for lenders, as they indicate past difficulties in managing credit. This can lead to potential lenders viewing you as a higher risk, which may affect their decision on whether to offer you a mortgage.

The Severity and Age of Defaults

The impact of defaults on your mortgage eligibility often depends on their severity and age. Recent defaults or those of a significant amount are likely to have a more substantial impact than older or smaller defaults. Some lenders may be more willing to consider your application if your defaults are several years old and you’ve demonstrated reliable financial behaviour since then.

High Street Banks vs. Specialist Lenders

High street banks often have stricter lending criteria and may be less likely to approve a mortgage application if you have defaults on your credit report. However, some specialist lenders or building societies cater to individuals with adverse credit histories. They consider a broader range of factors beyond just your credit score, such as your overall financial situation, the size of your deposit, and the affordability of the mortgage.

Tips for Securing a Mortgage Despite Defaults

If you have defaults on your credit report, here are some strategies that can increase your chances of securing a mortgage:

Improve Your Credit Score: Take steps to improve your credit score where possible. This could include paying off outstanding debts, ensuring you’re on the electoral roll, and avoiding further defaults or late payments.

Save a Larger Deposit: A larger deposit can help offset the risk perceived by lenders and increase your chances of mortgage approval.

Seek Professional Advice: Consider consulting with a mortgage broker who specialises in adverse credit. They can provide tailored advice and guide you towards lenders who are more likely to approve your application.

Be Honest: When applying for a mortgage, be upfront about your defaults. Lenders will find out about them through credit checks, and honesty can help build trust.

Remember, having defaults on your credit report doesn’t automatically disqualify you from getting a mortgage. With patience, planning, and the right approach, you can overcome these potential obstacles and secure a mortgage that suits your needs.

Taking Control of Your Credit Report and Debt Management

Taking control of your financial situation is crucial, especially when dealing with defaults on your credit report. By managing your debts effectively and making strategic decisions, you can improve your credit report and open up new financial opportunities. Here’s how you can take charge of your financial future.

The Importance of Taking Control of Your Financial Situation

Your credit report is a reflection of your financial history and behaviours. It’s used by lenders, landlords, and sometimes even employers to assess your financial reliability. Having defaults on your credit report can limit your access to credit, make it harder to secure a mortgage, and even affect your chances of renting a property or getting a job. Therefore, taking control of your financial situation is not just about money; it’s about your overall quality of life.

Strategies for Effective Debt Management

Effective debt management is key to improving your credit report. Here are some strategies you can use:

Budgeting: Create a realistic budget that covers your essential expenses and leaves room for debt repayment. This can help you avoid missing payments and accruing more debt.

Prioritising Debts: If you have multiple debts, prioritise them based on their interest rates and consequences of non-payment. Paying off high-interest debts first can save you money in the long run.

Negotiating with Creditors: If you’re struggling to make repayments, contact your creditors. Many are willing to negotiate payment plans or even reduce the amount you owe.

Seeking Professional Help: Consider seeking help from a debt advisor or credit counselling service. They can provide personalised advice and help you develop a debt management plan.

Improving Your Credit Report

In addition to managing your debts, there are specific steps you can take to improve your credit report:

Regularly Check Your Credit Report: Regularly review your credit report to ensure it’s accurate. If you find any errors, contact the credit reference agency to have them corrected.

Build a Positive Credit History: Consistently making payments on time and in full can help build a positive credit history. Even small bills like utilities or subscriptions can contribute to this.

Limit New Credit Applications: Each time you apply for credit, it leaves a mark on your credit report. Too many applications in a short period can negatively impact your credit score.

Keep Credit Utilisation Low: Try to use less than 30% of your available credit. High credit utilisation can be seen as over-reliance on credit and can negatively impact your credit score.

Taking control of your credit report and managing your debts effectively is a journey, not a destination. It requires consistent effort and financial discipline. But with time and dedication, you can improve your credit report, manage your debts, and secure your financial future.

Frequently Asked Questions

What happens to a default after 6 years?

In the UK, a default will automatically be removed from your credit report six years after the date it was recorded, regardless of whether or not the debt has been fully repaid. This is because the law limits how long information about past debt can stay on your credit report. However, it’s important to note that the debt itself still exists and creditors can still pursue repayment.

Do defaults disappear after 5 years?

No, defaults do not disappear from your credit report after 5 years. In the UK, defaults remain on your credit report for six years from the date of the default. After this period, they are automatically removed, but this doesn’t mean the debt is written off. The creditor can still pursue you for the debt.

Is a default still showing up after 6 years?

A default should not show up on your credit report after six years. If a default is still showing on your credit report after this time, you can contact the credit reference agency to have it removed. It’s a good idea to regularly check your credit report to ensure all information is accurate and up-to-date.

Will my credit score go up when a default is removed?

Yes, generally, your credit score will improve when a default is removed from your credit report. Defaults are negative marks that significantly impact your credit score. Once a default is removed, it no longer affects your credit score calculation, which can lead to an increase in your score. However, remember that credit scores are calculated using a variety of factors, so the exact impact will depend on the rest of your credit history.

References

The primary sources for this article are listed below.

Consumer Credit Act 1974 (legislation.gov.uk)

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.