Statute barred debts refer to a legal stipulation which sets a time limit during which a creditor can take court action to recover a debt. Beyond this time frame, unless certain conditions have been met, the debt effectively becomes “barred”. This doesn’t mean the debt is written off or that it ceases to exist, but it does alter the ways in which a creditor can legally claim the money owed to them.

It’s crucial to familiarise yourself with the rules surrounding statute barred debts as it can significantly impact how you navigate your financial responsibilities. Moreover, being aware of this concept may offer a layer of protection against any potential ill-intended debt recovery actions. In this article, we aim to provide a comprehensive understanding of statute barred debts, how to determine if your debts are eligible to be written off, and shed light on the time limits for recovering debts in England and Wales.

Quick Links

- What are Statute Barred Debts?

- The Impact of Time on Debts

- Are Your Debts Statute Barred?

- Time Limits for Recovering Debts in England and Wales

- Statute Barred Debts and Your Credit Score

- Can Creditors Still Contact You About a Statute Barred Debt?

- Navigating Statute Barred Debts

- Conclusion

- Take Control of Your Finances Today with Become Debt Free

- FAQs

- References

What are Statute Barred Debts?

Statute barred debts may seem intimidating at first glance. However, once we break it down into its essential components, its meaning becomes clear.

The word ‘statute’ refers to a written law that has been formally enacted by a legislative authority, such as the parliament in the UK. ‘Debt’ is a sum of money that is owed or due. ‘Limitation period’ refers to a legally defined time frame during which a particular action can be taken – in this context, it’s the period in which a creditor can take court action to reclaim a debt.

When we put these elements together, ‘statute barred debts’ refer to debts that have surpassed the limitation period prescribed by law. It means that the creditors can no longer use the legal system to enforce payment of these debts, as the time limit for doing so has expired.

The legislation that determines the limitation period for debts in England and Wales is the ‘Limitation Act 1980’. This Act stipulates the various time limits within which a creditor needs to initiate legal action to recover a debt. For most types of unsecured debt, such as credit cards, personal loans, and store cards, the limitation period is six years. This period begins from the date of the last payment or acknowledgement of the debt by the debtor.

Understanding the concept of statute barred debts can provide a debtor with valuable insight into their financial position. Recognising whether a debt has become, or is close to becoming, statute barred could significantly influence their approach to handling the debt and their interactions with creditors. In the next section, we will delve deeper into the criteria for a debt to be considered statute barred.

The Impact of Time on Debts

Time is a crucial element in the realm of debt management. The ‘time limit’ concept underpins the way debts can be pursued legally. The passage of time can shape the potential actions of both the debtor and creditor and, in certain circumstances, may even extinguish the legal obligation to repay the debt.

In legal parlance, the ‘prescription period’ refers to the time limit within which a creditor can take court action to recover a debt. If this period lapses without any action being taken or any acknowledgement from the debtor, the debt becomes ‘statute barred’, thereby shielding the debtor from legal action.

The prescription period varies depending on the type of debt involved. In England and Wales, under the Limitation Act 1980, these periods are as follows:

Unsecured Debts

The prescription period is six years from the date of the last payment or acknowledgement of the debt.

Mortgage Shortfalls

If a property is sold for less than the outstanding mortgage, the resulting ‘shortfall’ is subject to a twelve-year limitation period.

Council Tax Arrears

The local council has six years to obtain a Liability Order from the date the council tax was due.

Benefit Overpayments

There is usually a six-year limitation period, but there are exceptions.

Income Tax & Capital Gains Tax Debts

HM Revenue and Customs (HMRC) can chase these debts without any time limit if they result from a deliberate act.

County Court Judgements (CCJs)

Once a court judgement has been passed, the limitation period for enforcing it is typically six years. However, in certain circumstances, creditors can ask for permission to enforce older judgements.

Remember, these time limits refer to the period in which the creditor can take legal action. The debts do not simply disappear after the limitation period. They will remain in the background, and while creditors cannot use the court to recover the debt, they can still contact you to seek repayment.

Understanding these periods can equip individuals to make informed decisions about their financial situations. In the next section, we will explore the rules surrounding the commencement of the limitation period.

Are Your Debts Statute Barred?

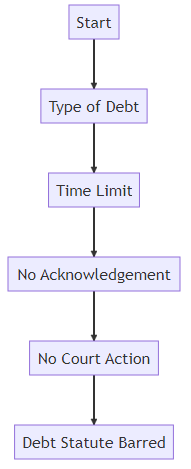

Understanding whether your debts could potentially become statute barred is crucial in managing your financial situation. A key point to note is that not all debts are eligible to be statute barred. For a debt to meet the criteria, a certain set of conditions must be met:

- Time Limit: The first condition is the passage of the limitation period. The specific period depends on the type of debt, as discussed in the previous section.

- Lack of Acknowledgement: The debtor must not have acknowledged the debt in writing or made a payment towards the debt during the limitation period.

- No Court Action: The creditor must not have obtained a court judgment against you within the limitation period.

Let’s consider some examples to illustrate this:

Example 1: Unsecured Debt

Say you had a credit card debt and you made your last payment seven years ago, without any written acknowledgement or court action in the intervening period. In this case, the debt is likely to be statute barred.

Example 2: Mortgage Shortfall

Suppose you sold a property ten years ago, which resulted in a mortgage shortfall. You haven’t made any payments or acknowledged the debt in writing, and there’s been no court judgment. Even though ten years have passed, the debt isn’t statute barred yet because the limitation period for mortgage shortfalls is twelve years.

Understanding these nuances can help you make informed decisions about dealing with your debts. In the next section, we will discuss the process to confirm if a debt is indeed statute barred.

Time Limits for Recovering Debts in England and Wales

In England and Wales, the Limitation Act 1980 sets forth specific time limits within which a creditor must start legal action to recover debts. If these time limits are surpassed without any legal action, acknowledgement, or payment, the debts could potentially become statute barred.

Below is a table that outlines the specific time limits for different types of debts:

| Type of Debt | Time Limit |

|---|---|

| Unsecured debts (e.g., credit card, personal loans) | 6 years |

| Mortgage shortfalls | 12 years |

| Council Tax arrears | 6 years |

| Rent arrears | 6 years |

| Benefit overpayments | 6 years |

| Income Tax & Capital Gains Tax debts | No time limit |

| Water bill debts | 6 years |

The R3 Statements of Insolvency Practice (SIPs) are a series of guidelines set out for Insolvency Practitioners in the UK, which outline best practices in insolvency cases, including the treatment of statute barred debts.

SIP 3.2, for example, stipulates that where an individual’s debt is statute barred, the Insolvency Practitioner should note this status in the report to creditors. They should also inform the debtor that the creditor may not be legally able to enforce the debt.

However, it’s important to note that while a debt may be statute barred, it doesn’t disappear completely. It still exists and can have impacts on your credit file, which we’ll discuss next.

Statute Barred Debts and Your Credit Score

Just as debt can significantly influence your financial standing, so too can it affect your credit score, even when it becomes statute barred. Understanding the interaction between statute barred debts and your credit score can be a crucial step in maintaining good financial health.

Even though a debt is statute barred and the creditor cannot force you to pay it through the courts, the debt can still appear on your credit record. A credit record, or credit file, is a comprehensive account of your credit history, compiled by credit reference agencies. These records provide potential lenders with a snapshot of your financial behaviour, helping them determine your creditworthiness.

Statute barred debts may appear on your credit record for six years from the date of the default notice. The default notice is a formal letter from your creditor stating that you’ve failed to maintain the terms of your credit agreement. A credit agreement is a legally binding contract between you and your creditor detailing the terms of your borrowing.

Therefore, if a debt is statute barred, but the default occurred within the past six years, the debt can still impact your credit score negatively. This can make it more challenging to secure new credit, rent property, or even get certain jobs.

However, after six years, the default (and thus the debt) should be removed from your credit file, even if it wasn’t fully paid. It’s always worth checking your credit report regularly to ensure that statute barred debts are removed as expected.

In the next section, we’ll discuss how to deal with statute barred debts when contacted by a creditor or a debt collection agency.

Can Creditors Still Contact You About a Statute Barred Debt?

Even if a debt is statute barred, creditors can technically still contact you. They may continue to request payment and send reminders or demands for the debt. However, they should inform you that the debt is statute barred if they are aware of it.

Despite these attempts to recover the debt, the key point is that once a debt is statute barred, a creditor cannot use court action to enforce you to pay it. If a creditor threatens to take court action against you for a statute barred debt, they may be in breach of the Financial Conduct Authority’s (FCA) rules. The FCA, which regulates most types of consumer credit, has rules in place to prevent harassment and unfair practices.

Furthermore, in some cases, if a creditor persists with excessive contact or uses misleading tactics, it may amount to harassment. Harassment from creditors is not only a breach of FCA rules but also a criminal offence under the Administration of Justice Act 1970. If you’re receiving undue pressure or misleading information from a creditor about a statute barred debt, you may wish to contact the Financial Ombudsman Service, a free and independent service for resolving disputes between consumers and financial businesses.

You can also contact the Citizens Advice or National Debtline for free advice on dealing with creditors and understanding your rights and obligations. However, if you receive court papers about a debt that you believe is statute barred, it is crucial to seek immediate legal advice to respond appropriately.

In the next section, we’ll explore how joint debts are treated in the context of statute barred debts.

Navigating Statute Barred Debts

Dealing with debt, statute barred or otherwise, can often be a daunting process. Yet, understanding your financial situation and seeking appropriate advice can significantly ease the stress and burden. Below are some recommendations to assist you in managing statute barred debts effectively.

Contacting National Debtline or Citizens Advice

Both the National Debtline and Citizens Advice offer free and confidential advice to individuals dealing with debt. They provide resources and guidance that can help you understand your financial situation, rights, and obligations better. Remember, it’s crucial to take action as soon as you realize you may not be able to handle your debt. The sooner you seek help, the more options you’ll have available to manage your debts.

Exploring Payment Plans

If a debt is not yet statute barred and you’re struggling to meet your payment obligations, it may be worthwhile to explore the possibility of a payment plan. A payment plan, agreed upon by both you and your creditor, can help you manage your debt more effectively. However, ensure that you fully understand the terms of the agreement, and only agree to a payment plan if you’re confident you can meet the proposed payment schedule.

Full Amount Settlements and Other Alternatives

In some situations, you may be able to negotiate a full and final settlement offer with your creditor. This means paying a lump sum, usually less than the total amount owed, to settle the debt once and for all. Keep in mind that any such agreement should be made in writing, and you should ensure you can afford the proposed settlement amount before agreeing to it.

In other instances, if your debts are large or you’re in severe financial difficulty, more formal debt solutions might be necessary, such as an Individual Voluntary Arrangement (IVA), a Debt Relief Order (DRO), or bankruptcy. These options come with significant implications and should be considered only after seeking advice from a debt advice agency or a qualified professional.

Conclusion

Understanding the complexities of statute barred debts can seem overwhelming at first. However, with a firm grasp of the key concepts, understanding your rights and responsibilities, and knowing when to seek advice can help you navigate this often confusing landscape.

In this article, we have unravelled the concept of statute barred debts, highlighted how time influences such debts, and discussed the eligibility criteria for debts to be written off. We also dove into specific time limits for debt recovery in England and Wales and discussed the potential impact of statute barred debts on your credit score.

Furthermore, we highlighted the fact that creditors may still be able to contact you about a statute barred debt, while providing some handy tips on how to manage these debts effectively. This guidance includes reaching out to support networks such as the National Debtline or Citizens Advice and considering various payment options.

Managing your finances needn’t be an uphill struggle. Equipped with the right information and tools, you can regain control of your financial health. We hope this article provides you with a solid understanding of statute barred debts. Remember, the journey to financial wellness is often a marathon, not a sprint, and every step you take toward learning and understanding your financial situation is a step in the right direction.

Take Control of Your Finances Today with Become Debt Free

Are you ready to overcome your financial struggles and pave the way to a debt-free life? If so, it’s time to take the next step with Become Debt Free.

As a leading insolvency practitioner based in Leeds, we specialise in providing IVAs and other financial solutions tailored to your unique situation. No matter where you are in the country, our team of experts is here to support you on your journey towards financial freedom.

Don’t let debt define your life. Give us a call today on 0800 169 1536 and find out how we can help you take back control of your financial situation. If you prefer, leave an enquiry on our website and one of our friendly team members will get back to you as soon as possible.

FAQs

What is a statute barred debt?

A statute barred debt is a type of debt that can no longer be pursued by creditors due to the expiration of a certain time limit, as specified in the Limitation Act.

What types of debts can become statute barred?

Various types of debts, such as credit card debts, personal loans, and council tax arrears can become statute barred. However, certain debts like court fines or student loans usually do not become statute barred.

How long is the limitation period for most debts?

In England and Wales, the limitation period for most types of unsecured debts is six years. This period starts from the date of your last payment or written acknowledgement of the debt.

Can a creditor still contact me about a statute barred debt?

Yes, a creditor can still contact you about a statute barred debt, but they cannot take you to court to reclaim the money. If you feel harassed, you can seek advice from Citizens Advice or the National Debtline.

References

The primary sources for this article are listed below.

Debt advice | Free debt advice | National Debtline | National Debtline

Statements of Insolvency Practice (SIPs) | England and Wales | ICAEW

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.