Debt can have a significant impact on our financial well-being, causing stress and limiting our opportunities. If you find yourself burdened with DWP debt, it’s time to take control and explore strategies that can transform your finances. In this article, we will introduce you to Repay My Debt DWP, a hidden strategy that can pave the way to financial freedom. By understanding DWP debt, discovering the strategy, and taking proactive steps, you can break free from the shackles of debt and build a brighter financial future.

Quick Links

Repay My Debt DWP – Discovering the Hidden Strategy

When it comes to tackling DWP debt and transforming your finances, there’s a hidden strategy that can make a significant impact. By implementing this strategy, you can pave the way to financial freedom and regain control over your economic well-being.

The hidden strategy revolves around three fundamental principles: planning, prioritization, and proactive action. By adopting these principles, you can develop a comprehensive approach to managing your debt and setting the stage for long-term financial stability.

Planning: Planning plays a crucial role in the hidden strategy. It involves assessing your current financial situation, understanding your income, expenses, and debt obligations. Start by creating a realistic budget that accounts for all your monthly income and expenses. This budget will serve as a roadmap, allowing you to allocate funds effectively toward debt repayment and other essential needs.

In addition to budgeting, consider developing a debt management plan. This plan should outline your strategies for repaying your DWP debt, such as identifying high-interest debts to prioritize or exploring debt consolidation options. Having a clear plan in place provides structure and empowers you to make informed decisions regarding your finances.

Prioritisation: Emphasizing the positive impact of implementing this strategy requires prioritization. Evaluate your various debts, including your DWP debt, and determine their relative importance and urgency. Prioritizing your debts involves considering factors such as interest rates, outstanding balances, and any legal implications associated with non-payment.

While it’s crucial to address all your debts, focusing on high-priority debts, such as those with the highest interest rates or those posing immediate consequences, can help you gain traction in your debt repayment journey. By strategically prioritizing your debts, you can allocate your resources effectively and expedite your progress toward becoming debt-free.

Proactive Action: The hidden strategy provides a pathway to financial freedom through proactive action. It’s not enough to simply create a plan and set priorities; taking consistent and purposeful steps is key. This involves actively engaging with your debt management process and exploring all available resources and options.

Consider reaching out to debt management experts who can provide guidance tailored to your specific circumstances. They can help you negotiate with creditors, explore debt consolidation options, or even provide insights on potential debt relief programs that may be applicable to your situation.

Moreover, stay informed about changes in legislation or regulations related to DWP debt and debt management in general. Being proactive and up-to-date ensures that you’re equipped with the latest information and can take advantage of any relevant opportunities or support available.

Implementing the hidden strategy is not an overnight solution. It requires consistent effort, discipline, and perseverance. However, by planning, prioritizing, and taking proactive action, you’re setting yourself on a path towards financial freedom. With each step you take, you’ll be one step closer to overcoming your DWP debt and achieving long-term financial stability.

To visually illustrate the hidden strategy, consider using a diagram or flowchart to demonstrate the interconnectedness of planning, prioritization, and proactive action. This can help readers better understand the strategy and its impact on their financial journey.

Remember, the hidden strategy is a powerful tool that empowers you to take control of your debt and transform your finances. Embrace this strategy and embark on the path to a brighter financial future.

Taking Control of Your Debt

When it comes to managing your DWP debt, taking proactive steps is crucial in gaining control over your financial situation. By following practical steps and utilizing available resources, you can effectively address your debt and pave the way towards a debt-free future.

1. Practical Steps for Taking Control: Taking control of your DWP debt begins with a proactive approach. Consider the following practical steps:

Assess Your Debt: Start by gathering all the necessary information about your DWP debt. Review any correspondence or documentation you have received from the DWP. Take note of the debt amount, any interest charges, and the timeline for repayment.

Review Your Budget: Evaluate your current budget and financial situation. Determine how much you can allocate towards debt repayment while still meeting your essential living expenses. Adjust your budget as needed to accommodate your debt repayment plan.

Reduce Expenses: Look for areas where you can cut back on expenses to free up additional funds for debt repayment. This may involve making temporary lifestyle adjustments or finding ways to save on everyday expenses.

Increase Income: Explore opportunities to increase your income. This can involve taking on additional part-time work, freelancing, or seeking a higher-paying job. The extra income can be dedicated to accelerating your debt repayment.

Explore Debt Repayment Strategies: Investigate various debt repayment strategies and choose the one that aligns with your financial goals and capabilities. Options may include the snowball method (paying off smaller debts first), the avalanche method (tackling debts with the highest interest rates first), or debt consolidation.

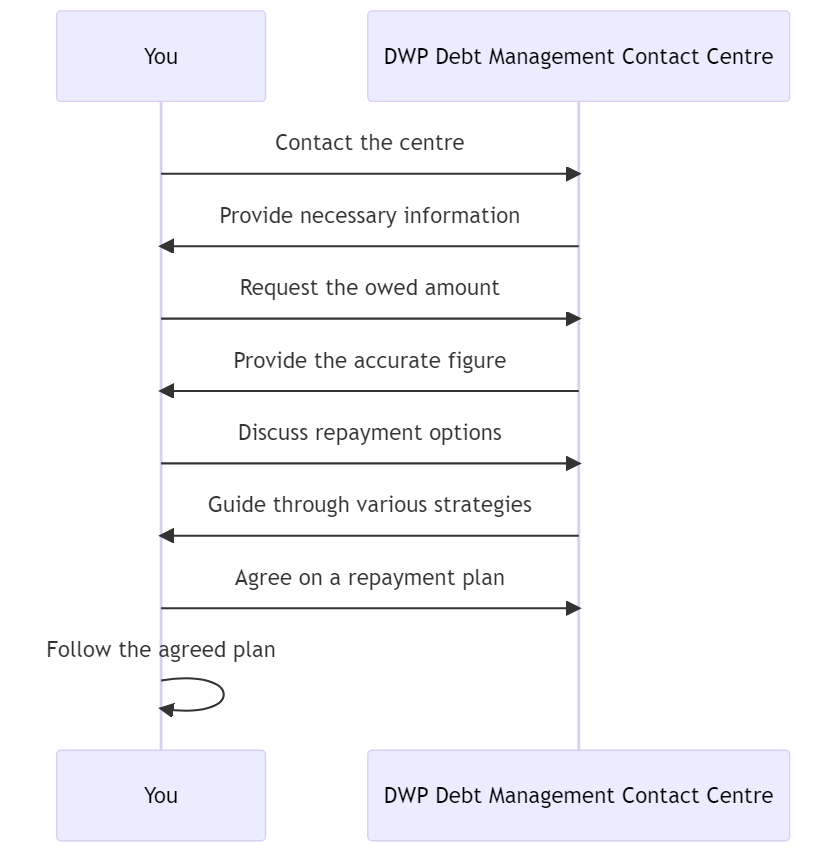

2. Contacting the DWP Debt Management Contact Centre: Contacting the DWP Debt Management Contact Centre is an essential step in managing your DWP debt effectively. The contact centre provides guidance and support throughout the debt management process. Here’s why it’s important:

Clarity on Debt Amount: By contacting the DWP Debt Management Contact Centre, you can obtain accurate and up-to-date information about the amount you owe. This ensures you have a clear understanding of your debt obligations.

Repayment Options: The contact centre can inform you about available repayment options based on your circumstances. They can discuss installment plans, negotiate affordable repayment schedules, or explore potential debt relief programs, depending on your situation.

Communication and Updates: Establishing contact with the DWP Debt Management Contact Centre ensures ongoing communication regarding your debt. They can provide updates on any changes, answer your queries, and guide you through the process.

3. Exploring Repayment Options: Finding out the owed amount and exploring repayment options is an integral part of taking control of your DWP debt. Here’s an overview of the process:

Managing your DWP debt involves understanding the amount owed and exploring repayment options. Start by contacting the DWP Debt Management Contact Centre to express your intention to address the debt. Request the specific amount owed, including any interest or charges. Discuss repayment strategies with the representative, such as instalment plans or feasible repayment terms. Once a plan is agreed upon, ensure regular payments to stay on track with your repayment goals. This process, while requiring commitment, leads to debt resolution and financial stability.

Navigating the Debt Management Process

Effectively managing your DWP debt requires a clear understanding of the steps involved in the debt management process. By navigating this process strategically, you can take control of your debt and work towards achieving financial stability. In this section, we will outline the key steps, emphasize the importance of understanding relevant legislation in England & Wales, and discuss the role of R3 Statements of Insolvency Practice in debt management.

1. Key Steps in Managing DWP Debt Effectively:

a. Assessment and Organization: Begin by assessing your overall financial situation, including your income, expenses, and debts. Organize your debt-related documents, such as correspondence from the DWP and any relevant financial statements.

b. Communication with DWP: Maintain open lines of communication with the DWP Debt Management Contact Centre. Notify them promptly of any changes in your circumstances that may impact your ability to make payments. Engage in constructive dialogue to explore suitable repayment options.

c. Understanding Relevant Legislation: Familiarize yourself with the relevant legislation in England & Wales concerning debt management. Understanding your rights, responsibilities, and legal obligations will empower you to navigate the debt management process effectively.

d. Exploring Debt Resolution Options: Investigate debt resolution options available to you. This may include negotiating with creditors, pursuing debt consolidation, or seeking professional advice to explore options such as an Individual Voluntary Arrangement or a Debt Relief Order. Explore each option’s benefits and implications to determine the most appropriate course of action.

If you are struggling with an outstanding debt with DWP and would like to discuss options such as an Individual Voluntary Arrangement, contact us here at Become Debt Free today on 0113 237 9500.

e. Creating a Repayment Plan: Develop a comprehensive repayment plan tailored to your financial situation. Consider factors such as your income, expenses, and the urgency of different debts. Allocate funds accordingly and establish a realistic timeline for repayment.

f. Implementing the Repayment Plan: Put your repayment plan into action by making consistent and timely payments towards your DWP debt. Stay committed to the plan, and if necessary, revisit and adjust it periodically to accommodate any changes in your circumstances.

2. Importance of Understanding Relevant Legislation:

Understanding the relevant legislation in England & Wales is crucial for effective debt management, particularly when dealing with DWP debt. The legislation provides a framework that governs debt collection practices, protects consumers’ rights, and ensures fair treatment throughout the process. It is important to be aware of the following:

Consumer Rights: Understanding your rights as a consumer can protect you from unfair debt collection practices. Familiarize yourself with legislation, such as the Consumer Credit Act and the Financial Conduct Authority (FCA) guidelines, to ensure your rights are upheld.

Debt Collection Laws: Debt collection in England & Wales is regulated by legislation, such as the Consumer Credit Act 1974 and the Administration of Justice Act 1970. These laws outline the permissible actions creditors can take in pursuing debt repayment, as well as the rights and protections afforded to debtors.

Debt Enforcement: Become familiar with the legal processes involved in debt enforcement, such as County Court Judgments (CCJs) and enforcement action. Understanding these processes will enable you to navigate them effectively and seek appropriate advice if needed.

3. Role of R3 Statements of Insolvency Practice:

R3 Statements of Insolvency Practice (SIPs) provide guidelines for insolvency professionals in England & Wales. While primarily focused on insolvency, certain SIPs offer valuable insights applicable to debt management. Key aspects include:

Best Practice: SIPs outline best practices for professionals involved in the insolvency process. Adhering to these practices ensures that debt management is conducted ethically, transparently, and in compliance with regulatory standards.

Creditor Communication: SIPs emphasize effective communication with creditors, promoting transparency and cooperation throughout the debt management process. By following SIPs, professionals foster constructive dialogue and facilitate mutually agreeable solutions.

Professional Standards: SIPs set the benchmark for professional conduct, ensuring that individuals involved in debt management uphold the highest standards of professionalism and integrity.

By familiarizing yourself with the relevant legislation in England & Wales and understanding the role of R3 SIPs, you can navigate the debt management process confidently and in accordance with legal and ethical guidelines.

Remember, effective debt management involves not only understanding the process but also seeking professional advice when needed. Here at Become Debt Free, our professional friendly advisors can provide tailored guidance based on your specific circumstances, helping you make informed decisions and regain control of your financial well-being.

Strategies for Repayment and Resolution

Repaying your DWP debt requires careful planning and the implementation of effective strategies. In this section, we will provide practical tips and strategies to help you repay your DWP debt, discuss the option of seeking professional advice from debt management experts, and mention the resources and support available online and through the DWP.

1. Practical Tips for Repaying DWP Debt:

Assess Your Financial Situation: Start by evaluating your overall financial situation. Determine your income, expenses, and the amount of debt you owe to the DWP. This assessment will provide a clear picture of your financial standing and help you plan your debt repayment strategy effectively.

Create a Realistic Budget: Develop a budget that reflects your income, essential expenses, and debt repayment goals. Allocate a portion of your income specifically towards repaying your DWP debt. By prioritizing debt repayment in your budget, you can ensure that you are consistently setting aside funds to tackle your debt.

Cut Down on Expenses: Identify areas where you can reduce unnecessary expenses. Minimize discretionary spending and focus on prioritizing your debt repayment goals. Consider making temporary sacrifices or adjustments to your lifestyle to free up additional funds that can be directed towards paying off your DWP debt.

Increase Your Income: Explore opportunities to increase your income, such as taking on a part-time job or freelancing. Consider utilizing your skills or talents to generate additional income streams. The extra income can be dedicated towards accelerating the repayment of your DWP debt.

Negotiate Repayment Terms: Reach out to the DWP Debt Management Contact Centre to discuss possible repayment options. Explain your financial situation and inquire about the possibility of negotiating more favorable repayment terms. They may be willing to offer alternative arrangements or flexible payment plans that better suit your circumstances.

2. Seeking Professional Advice from Debt Management Experts:

Consider seeking professional advice from debt management experts who specialize in assisting individuals with their financial challenges. Here’s why it can be beneficial:

Expert Guidance: Debt management experts possess the knowledge and experience to provide tailored guidance based on your specific situation. They can analyze your finances, assess your debt repayment options, and offer valuable advice on how to effectively manage your DWP debt.

Negotiation Support: Debt management experts can act as intermediaries between you and the DWP. They can negotiate on your behalf to secure more favorable repayment terms, potentially reducing the amount owed or arranging affordable payment plans that align with your financial capabilities.

Debt Management Plans: These experts can help you develop a debt management plan tailored to your unique circumstances. They will work with you to create a structured plan that outlines your debt repayment goals and strategies. Debt management plans provide a roadmap for tackling your DWP debt systematically.

3. Resources and Support Available Online and through the DWP:

Take advantage of the resources and support available online and through the DWP to aid you in your debt repayment journey. Consider the following:

DWP Website: Visit the official DWP website to access information on debt management and debt repayment options. The website provides valuable resources, guidelines, and updates related to managing your DWP debt effectively.

DWP Debt Management Contact Centre: Reach out to the DWP Debt Management Contact Centre for personalized assistance. They can provide information about your specific debt, repayment options, and address any queries or concerns you may have.

Online Debt Management Tools: Utilise online tools and calculators to assess your debt repayment strategies. These tools can help you create a repayment plan, estimate repayment timelines, and track your progress as you work towards becoming debt-free.

Debt Support Charities and Organizations: Explore debt support charities and organizations that offer free advice and support to individuals facing debt challenges. These resources can provide guidance, financial literacy education, and counselling services to assist you in managing your DWP debt effectively.

By implementing practical strategies, seeking professional advice, and utilizing available resources, you can navigate the journey towards repaying your DWP debt with greater confidence. Remember, each step you take brings you closer to achieving financial freedom and peace of mind.

Maintaining Financial Freedom

To maintain financial freedom and prevent future debt, follow these tips:

- Monitor Benefit Payments, Income, and Expenses:

- Stay updated on benefit payments and report any changes in your circumstances to the DWP promptly.

- Keep track of your income and expenses to understand your financial situation better.

- Regularly review and revise your budget to align with your current financial reality.

- Tips for Budgeting, Saving, and Making Informed Decisions:

- Practice smart spending by differentiating between wants and needs and cutting down on discretionary expenses.

- Build an emergency fund to handle unexpected expenses without resorting to credit or additional debt.

- Prioritize saving for future goals, such as education, homeownership, or retirement.

- Make informed financial decisions by comparing options, reading terms and conditions carefully, and seeking advice from professionals.

By closely monitoring benefit payments, income, and expenses, practicing effective budgeting and saving, and making informed financial decisions, you can maintain financial freedom and avoid falling back into debt. Remember, maintaining financial stability requires discipline, self-awareness, and a proactive approach to managing your finances.

Conclusion

Repaying DWP debt is a significant challenge, but with the right strategies and resources, it is possible to overcome financial obstacles and achieve freedom from debt. In this article, we have explored the hidden strategy that can transform your finances and discussed the importance of taking control of your debt. We also highlighted the key steps involved in navigating the debt management process and provided practical tips for repayment and resolution.

If you are struggling financially and would like to talk to someone about your debts, contact us here at Become Debt Free today on 0113 237 9500 or usin the WhatsApp link below!

FAQs

How do I get my DWP debt written off?

Getting your DWP debt written off is not a straightforward process. The DWP may consider writing off a debt in certain circumstances, such as when it is deemed uncollectible or if there has been an error on their part. To explore the possibility of having your DWP debt written off, it is advisable to contact the DWP Debt Management Contact Centre and discuss your specific situation with them. They will provide guidance on the steps you need to take and the documentation required for further assessment.

How far back can DWP claim overpayments?

The DWP has the legal authority to claim overpayments for a specific period. The time limit for claiming overpayments depends on the type of benefit received and the circumstances surrounding the overpayment. Generally, the DWP can go back up to six years to claim overpayments, but in certain cases, such as fraud or misrepresentation, they can go back further. It is crucial to engage with the DWP Debt Management Contact Centre to understand the specific rules and regulations governing the time limit for overpayment claims in your situation.

Can the DWP check my bank account?

The DWP has the authority to request and access relevant financial information, including bank account details, in specific circumstances. They may do so to verify eligibility for benefits, investigate potential fraud, or assess overpayments. However, the DWP must follow the necessary legal procedures and protocols when requesting access to your bank account information. It is important to note that they require proper authorization and should inform you in advance if they intend to access your bank account details.

How do I find out what I owe to DWP?

To find out the amount you owe to the DWP, you can take the following steps:

- Contact the DWP Debt Management Contact Centre: Get in touch with the DWP Debt Management Contact Centre through their helpline or online platform. Provide them with your relevant details, such as your National Insurance number and any other information they may require. They will be able to provide you with accurate information regarding your outstanding debt.

- Check Your Correspondence: Review any correspondence you have received from the DWP regarding your debt. This may include letters, emails, or notifications sent through your online account. These communications often contain information about the owed amount and steps to resolve the debt.

- Access Your Online Account: If you have an online account with the DWP, log in and navigate to the relevant section that displays your debt information. This online platform allows you to access your account details, outstanding balances, and payment history.

References

The primary sources for this article are listed below.

Department for Work and Pensions – GOV.UK (www.gov.uk)

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.