Discover a firsthand account of dealing with Marstons Bailiffs. Learn from one debtor’s experience, how they managed the situation, and the lessons they learned

Marstons Bailiffs are an enforcement company, which means they are bailiffs, not debt collectors. They are often employed to recover debts on behalf of local authorities, businesses, and individuals. Their visit can be intimidating, but it’s crucial to remember that you have rights and options. This firsthand account aims to shed light on the experience, offering insights and practical advice on how to handle such a situation effectively.

Quick Links

The Unexpected Visit

It was a day like any other, the morning routine was in full swing, and the day’s tasks were already lining up. Suddenly, there was a knock at the door, a knock that would change the course of the day and indeed, life as it was known. Standing at the doorstep were the Marstons Bailiffs enforcement agents.

The sight of the bailiffs was unexpected and intimidating. The uniform, the official-looking paperwork, and the stern expressions were enough to send a wave of panic. The reality of the situation began to sink in – the outstanding debt had escalated to the point of enforcement action.

The initial reaction was a mix of fear, confusion, and a sense of invasion. The home, usually a sanctuary, suddenly felt exposed and vulnerable. The presence of the bailiffs brought the issue of the debt sharply into focus, making it impossible to ignore or delay any longer.

However, amidst the initial shock, it was crucial to remember that this was not the end of the world. It was a difficult situation, yes, but not an insurmountable one. This was the beginning of a journey towards resolution and, ultimately, financial freedom.

Who are Marstons Bailiffs and what they do.

Marstons Bailiffs, part of Marston Holdings, is a company that provides a range of services including debt recovery and parking enforcement.

Their debt recovery service is particularly noteworthy. They claim to take an ethical approach to delivering court order enforcement and corporate debt recovery services while treating people fairly. They have a vulnerability strategy that includes a Samaritan-trained Welfare Support Team.

In the context of this article, it’s important to understand that Marstons Bailiffs, as enforcement agents, have certain powers and legal rights. They are authorised to recover money, property, and assets as part of their debt recovery services. However, it’s equally important to know your rights and the limits of their powers when dealing with them.

How I Handled the Situation

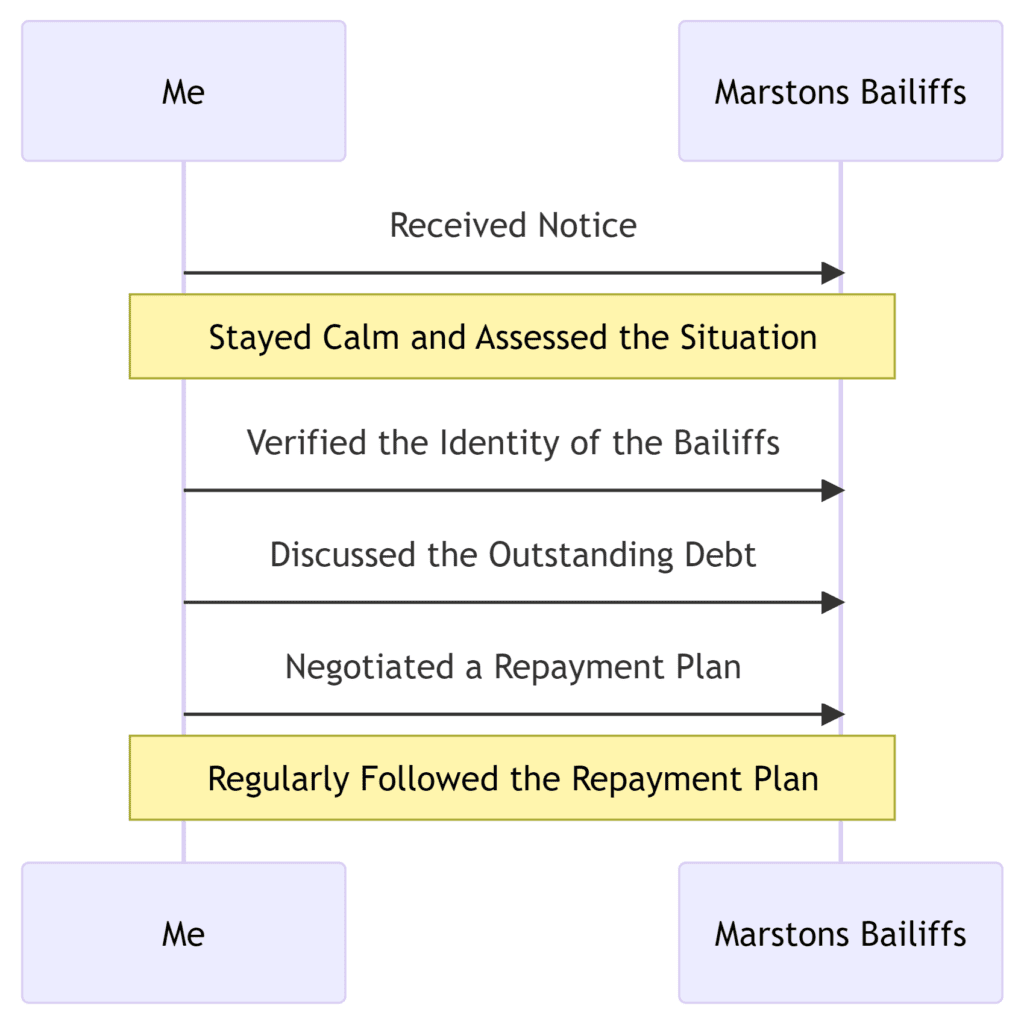

When dealing with Marstons Bailiffs, it’s essential to approach the situation with a clear mind and a solid plan. Here’s how I managed the situation:

- Stay Calm: The initial shock of receiving a notice from Marstons Bailiffs can be overwhelming. However, it’s crucial to stay calm and not let panic cloud your judgement. Remember, you have rights and options.

- Verify the Identity of the Bailiffs: Before engaging in any discussion, I made sure to verify the identity of the bailiffs. This is a crucial step to ensure that you’re dealing with legitimate enforcement agents.

- Discuss the Outstanding Debt: Once I confirmed their identity, I discussed the outstanding debt with them. It’s important to understand the amount you owe and why you owe it.

- Negotiate a Repayment Plan: After understanding the debt, I negotiated a repayment plan with the bailiffs. This step is crucial as it allows you to manage your debt in a way that’s feasible for you.

- Follow the Repayment Plan: Once a repayment plan was in place, I made sure to follow it regularly. Consistency is key in ensuring that the debt is paid off without any additional issues.

Here’s a visual representation of the steps I took:

Important! Never let a bailiff into your home.

It’s crucial to remember that you should not allow a bailiff into your home under any circumstances. Once they gain peaceful entry, they have the right to return and potentially enter your property to seize your possessions. If you permit them entry once, it becomes significantly more challenging to prevent them from taking your belongings when they return.

Here’s a list of items that Marston Bailiffs are permitted to seize from your home:

- Your television and any gaming consoles

- Jewellery, ornaments, and antiques

- Any cash present in your property

- In specific situations, they may even have the authority to tow or clamp your vehicle. However, they cannot seize it if you’re a blue badge holder, if the vehicle is jointly owned, or if it was acquired through a hire purchase agreement.

However, bailiffs are not allowed to take:

- Essential items for your work, such as tools, a computer, or a work vehicle

- Necessary items for living, such as your cooker, clothes, or refrigerator

- Your children’s toys or any household pets

It’s also important to note that bailiffs can only enter your home between the hours of 6 am and 9 pm.

Steps to Take Following Agreement of Repayment Plan

Once you’ve negotiated and agreed upon a repayment plan with Marstons Bailiffs, it’s crucial to stick to it. Here are the steps you should take:

- Understand Your Repayment Plan: Make sure you fully understand the terms of your repayment plan. Know the amount you have to pay, the frequency of payments, and the duration of the plan.

- Set Up Payments: Arrange for the payments to be made on the agreed dates. This could be through direct debit, online transfers, or any other method agreed upon with the bailiffs.

- Keep Records: Maintain a record of all payments made towards the debt. This could be in the form of bank statements, receipts, or any other proof of payment.

- Stay in Contact: Keep the lines of communication open with Marstons Bailiffs. If you’re struggling to make a payment or if your financial situation changes, let them know as soon as possible.

- Review Your Budget: Regularly review your budget to ensure you can continue to make the agreed payments. Cut back on non-essential spending if necessary.

- Seek Advice: If you’re struggling to keep up with payments, seek advice from a debt advice service. They can provide guidance on how to manage your situation.

Debt Solutions If You Can’t Afford Repayments

If you find that you’re unable to afford the agreed repayments, there are several debt solutions available:

- Debt Management Plan (DMP): This is an informal agreement between you and your creditors to pay back non-priority debts. Non-priority debts are things like credit cards, loans and store cards. You pay back the debt by one set monthly payment, which is divided between your creditors.

- Individual Voluntary Arrangement (IVA): This is a formal agreement where you make regular payments to an insolvency practitioner, who then divides this money between your creditors. An IVA can give you more control of your assets than bankruptcy.

- Debt Relief Order (DRO): If you have a low income, minimal assets and less than £20,000 of debt, you might be eligible for a DRO. While a DRO is in effect, you don’t have to make payments towards most types of debt included in your DRO and your creditors can’t force you to pay off the debts.

- Bankruptcy: This is a last resort if you can’t pay back your debts. Any assets you own might be used to pay off your debts. While you’re bankrupt, you don’t have to make payments towards most debts included in your bankruptcy.

Remember, it’s important to seek professional advice before deciding on a debt solution. Each solution has its own implications that can affect your financial situation in different ways.

Conclusion

Looking back on the day Marstons Bailiffs came knocking, it was undoubtedly a stressful and challenging experience. The fear and uncertainty were overwhelming, but it was a situation that needed to be faced head-on. The key to navigating through it was staying calm, understanding my rights, and taking control of the situation.

The experience taught me a lot about debt, enforcement agencies, and the importance of managing finances responsibly. It was a wake-up call that prompted me to reassess my financial habits and seek the necessary help to get back on track.

If you ever find yourself in a similar situation, remember that you are not alone. There are numerous resources and organisations that can provide advice and support. Don’t be afraid to reach out to them. It’s crucial to understand that there are always options available, no matter how dire the situation may seem.

Remember, it’s not about how hard you fall, but how quickly you get back up. Stay strong, stay informed, and you will overcome.

Frequently Asked Questions

Can Marstons bailiffs force entry?

Marstons bailiffs, like all bailiffs, have certain powers, but they cannot usually force their way into your home. They can only enter your property if you invite them in or they enter through an unlocked door (known as ‘peaceful entry’). They are not allowed to break down doors or enter through windows.

How can I make a complaint about Marstons Enforcement?

If you have a complaint about Marstons Enforcement, you should first contact them directly and follow their complaints procedure. If you are not satisfied with their response, you can escalate your complaint to the Civil Enforcement Association if Marstons is a member.

How many times can a bailiff visit?

There is no limit to the number of times a bailiff can visit you. However, they must follow certain rules, such as visiting at reasonable hours (usually between 6 am and 9 pm), and they must give you seven days’ notice before their first visit.

How do I contact Marstons Bailiffs?

You can contact Marstons Bailiffs through various methods. The most direct way is by phone.

- Automated payment line, call 0333 320 1100.

- To speak to one of their team to make a payment or to discuss your circumstances, call 0333 320 1822.

- email: generalenquiries@marstonholdings.co.uk

- Opening hours: 8am to 8pm Monday to Friday, 8am to 4pm on Saturdays.

References

The primary sources for this article are listed below.

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.