Individual Voluntary Arrangements (IVAs) are a popular debt solution in the UK, offering a legally binding agreement between you and your creditors. But one question that often arises is: “How long does an IVA last?” In this comprehensive guide, we will uncover the facts, dispel the myths, and help you understand the implications of an IVA on your financial future.

Quick Links

What is an IVA?

An Individual Voluntary Arrangement (IVA) is a formal and legally binding agreement between you and your creditors to pay back your debts over a set period. It’s a form of insolvency but unlike bankruptcy, it allows you to retain more control over your assets.

The Duration of an IVA

Typically, an IVA lasts for a fixed term of 5 years (60 months), but this can vary depending on your individual circumstances. In some cases, it can be extended to 6 years (72 months) if you’re a homeowner and unable to re-mortgage your property.

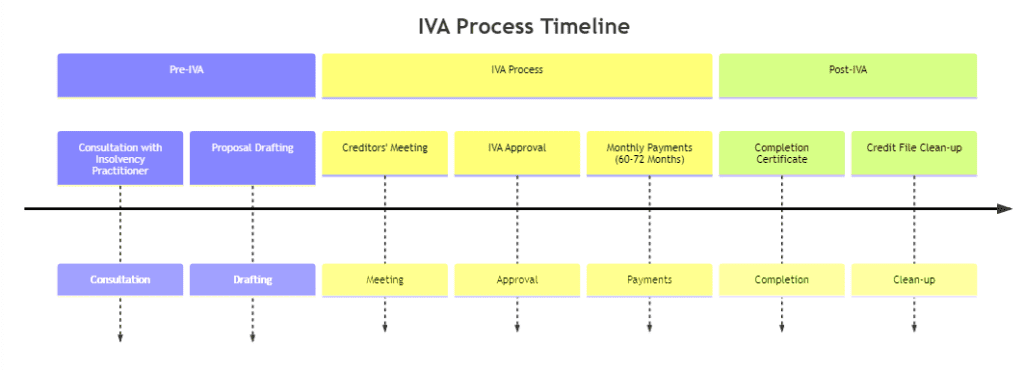

Here is a simple timeline of the IVA process:

Factors Influencing the Duration of an IVA

Several factors can influence the duration of your IVA:

- Monthly Payments: The standard duration of an IVA is typically five years, with 60 monthly payments. However, if your monthly repayments are relatively low compared to the total amount of debt you owe, your creditors may request an extension of up to 12 months. This extension allows them to maximize the return on their investment by collecting more from your monthly contributions.

- IVA Lump Sum Payment: If you happen to receive a significant sum of money while in an IVA, such as an inheritance, third party lump sum offer or a lottery win, you may have the option to make a lump sum payment toward your outstanding debt. By making this payment, you can potentially reduce the overall duration of your IVA. The insolvency practitioner will assess the impact of the IVA lump sum payment on your outstanding debt and negotiate with creditors accordingly.

- Changes in Financial Circumstances: If your financial situation experiences a significant change during your IVA, such as a substantial increase in income or a windfall, your insolvency practitioner may review your terms. Depending on the circumstances, they may consider adjusting the duration of the IVA. If your income increases, it could result in higher monthly repayments, which may lead to a reduction in the overall repayment period if it meant that the debts and costs of the IVA would be paid in full in less than 5 years. Conversely, if your financial circumstances deteriorate, an extension of the IVA term might be required to accommodate the changes.

- Payment Breaks: In certain situations, you may be allowed to take payment breaks during your IVA. These breaks can provide temporary relief if you face unexpected financial difficulties or emergencies. However, it’s important to note that while payment breaks can help you manage short-term challenges, they will extend the overall duration of your IVA. The missed payments during the break will need to be made up later, extending the repayment period accordingly.

- Equity Release: If you own a home, your IVA may include a provision that requires you to release equity from your property in the final year of the arrangement. This means you may be required to re-mortgage your property or explore other options to release the equity. If you are unable to re-mortgage or release the required equity, your IVA may be extended for an additional 12 months to provide creditors with a chance to recover more funds.

It’s important to consult with a qualified insolvency practitioner who can assess your individual circumstances and guide you through the specific terms and conditions of your IVA. Here at Become Debt Free, we have our own in-house licenced Insolvency Practitioner with decades of experience. Contact us today and speak with one of our professional advisors for a no obligation chat about your circumstances on 0113 237 9503.

The Impact of an IVA on Your Credit

An IVA will remain on your credit file for six years from the date it starts. This can make it more difficult to obtain credit during this time. However, once the IVA is removed from your credit file, it’s possible to rebuild your credit score.

Conclusion

Understanding the duration of an IVA and its impact on your financial situation is crucial when considering this debt solution. While an IVA can provide a path to becoming debt-free, it’s important to fully understand the commitment you’re making. Always seek professional debt advice before entering into an IVA.

If you are struggling with debts and would like to explore whether an IVA is right for you or whether another debt solution is more appropriate such as a Debt Relief Order or Bankruptcy. Contact us here at Become Debt Free today on 0113 237 9503 or via the WhatsApp link below.

FAQs

What happens after 5 years of IVA?

Once you’ve reached the end of your 5-year IVA term and have made all your agreed payments, your IVA is considered completed. At this point, any remaining unsecured debt included in your IVA is written off. You will receive a completion certificate from your insolvency practitioner, which serves as proof that you have successfully fulfilled your IVA obligations. It’s a significant milestone, marking the end of your journey towards financial recovery. However, it’s important to continue managing your finances responsibly to avoid falling into debt again.

Can you get credit again after an IVA?

Yes, it is possible to get credit again after completing an IVA, but it may be more challenging. An IVA stays on your credit file for six years from the start date, which can affect your credit score and make lenders more cautious about offering you credit. However, over time, as you begin to rebuild your credit history, obtaining credit will become easier. It’s crucial to ensure that you can afford any new credit commitments to avoid falling back into debt.

Do I have to declare an IVA after 6 years?

No, you don’t have to declare an IVA after six years have passed from the start date. Once this period is over, the IVA is removed from your credit file, and you’re no longer obligated to inform potential lenders of your past IVA. However, some lenders may ask if you’ve ever been in an IVA, and it’s important to answer honestly.

How long does an IVA last on your credit report?

An IVA stays on your credit report for six years from the start date, regardless of when it is completed. This means that even if you complete your IVA in five years, it will still remain on your credit report for an additional year. During this time, it may be more difficult to obtain credit, and you may face higher interest rates.

What happens to my IVA if I get a pay rise?

If you get a pay rise during your IVA, you must inform your insolvency practitioner as soon as possible. They will reassess your financial situation and may decide to increase your monthly IVA payments. This is because an IVA is based on what you can afford to pay, so if your income increases, your payments may also increase. However, the term of your IVA usually remains the same, and any extra money you pay will go towards clearing your debts more quickly.

References

The primary sources for this article are listed below.

Find an insolvency practitioner – GOV.UK (www.gov.uk)

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.