Uncover the surprising facts on ‘How Long Do Bankruptcies Last UK’. Empower yourself with knowledge and regain control of your financial future today.

Bankruptcy offers an opportunity to wipe the slate clean, albeit with significant consequences. It’s a journey that can drastically alter an individual’s financial standing, credit profile, property ownership, and even personal life. But how long does this process last? How much of your life gets enveloped in the bankruptcy period? These are some of the questions we’ll delve into in this article.

Quick Links

- How Long Do Bankruptcies Last UK: Unveiling the Surprise

- How Bankruptcy Affects You: Beyond Financial Impact

- Motor Vehicles and Bankruptcy: Navigating the Roads of Debt

- Navigating Post-Bankruptcy Life: Repairing Your Credit Profile

- The Importance of Obtaining a Discharge Certificate

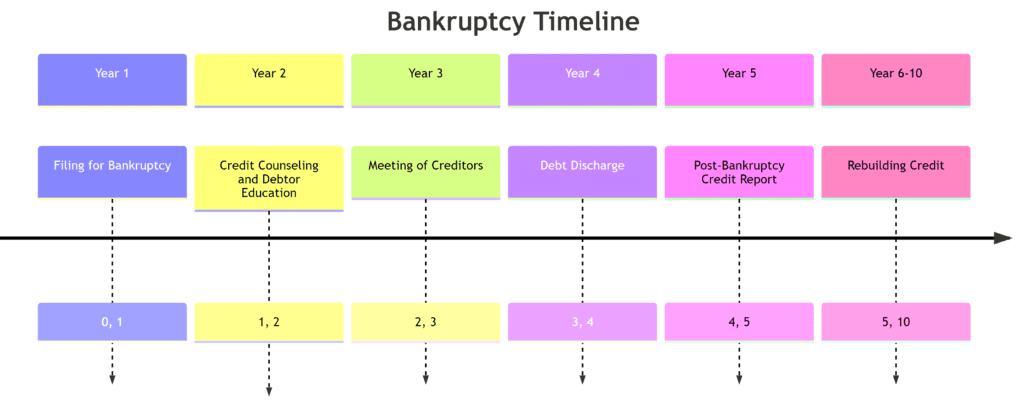

- Bankruptcy Timeline

- Frequently Asked Questions

- References

How Long Do Bankruptcies Last UK: Unveiling the Surprise

Now, let’s delve into the core issue at hand: how long do bankruptcies last UK?

The answer, perhaps surprisingly, isn’t straightforward. On paper, the bankruptcy period in England and Wales typically lasts for one year from the date of the bankruptcy order. However, the ramifications of bankruptcy continue to reverberate long after this formal period has ended, making the practical duration much longer.

During the one-year bankruptcy period, the debtor is subject to numerous restrictions. They are unable to secure additional credit over £500 without disclosing their bankruptcy status. Restrictions may also extend to the individual’s ability to act as a company director or establish a new business without the court’s approval.

While these restrictions generally cease after the one-year period, the bankruptcy remains on the public individual insolvency register until it’s officially discharged. This record can be accessed by anyone, including potential landlords or employers, and could influence their decisions.

Furthermore, the bankruptcy also remains on the debtor’s credit file for six years, significantly impacting their credit rating. Credit reference agencies, including Experian, Equifax, and TransUnion, maintain these records and share them with prospective creditors. A bankruptcy mark on a credit profile can result in limited access to credit and higher borrowing costs, making it difficult for the individual to regain a stable financial footing.

The actual costs associated with bankruptcy also extend beyond the bankruptcy period. Although a debtor’s unsecured debts are typically written off at the end of the bankruptcy, they may need to make contributions towards these debts from their income under an income payments agreement or an income payments order. These contributions can continue for up to three years.

Moreover, the effect on the debtor’s life is not limited to finances alone. Bankruptcy can lead to the loss of valuable assets, including the family home or vehicle, if these were included as part of the bankruptcy estate. While not all possessions are lost, the potential loss of property, especially the family home, can have profound emotional and psychological effects.

Therefore, when asking ‘How long do bankruptcies last UK?’, it’s crucial to consider the broader implications. While the formal period is typically one year, the impact on the individual’s life, both financially and personally, is much more enduring.

Now let’s move on to the next section, where we explore how one can navigate the post-bankruptcy period and steps to rebuild their credit profile.

How Bankruptcy Affects You: Beyond Financial Impact

In addition to the financial impact, bankruptcy profoundly influences various aspects of a person’s life, including personal relationships, emotional health, and overall lifestyle. Let’s explore these areas further.

Impact on Assets and Property

One of the most immediate and tangible effects of bankruptcy is the potential loss of assets. Upon declaring bankruptcy, control over your assets transfers to the official receiver or a trustee, who assesses what can be used to pay back your debts.

Property, particularly your family home, can be included in your bankruptcy estate, meaning it could potentially be sold. This doesn’t happen immediately, though. You’ll usually be given a year to make alternative living arrangements. If you have a spouse or children living with you, their needs will be considered. You may also have the option to buy back your beneficial interest or find someone else who can do so.

One of the effects of bankruptcy is that property of the bankrupt vests in the Trustee. The Trustee should realise his interest in the debtor’s family home within a three year period.

Your vehicle could also be sold to help pay your creditors, particularly if it’s considered valuable or if cheaper alternatives are available. However, if you need your car for work or certain other reasons, you may be allowed to keep it.

Impact on Income

Your income isn’t left untouched, either. If you have surplus income after covering your basic living costs, you might be asked to make regular payments towards your debts through an Income Payments Agreement (IPA) or an Income Payments Order (IPO). This can last for three years, even beyond the usual one-year bankruptcy period.

Impact on Credit Profile

As previously discussed, bankruptcy remains on your credit file for six years, significantly impacting your credit profile. This can make it difficult to secure loans, mortgages, or even some types of employment. Overcoming this requires rebuilding your credit score, which we’ll cover later in this article.

Impact of Bankruptcy on Gender Change

In the context of a gender change, it’s worth noting that if you change your name and gender during the bankruptcy process, the public insolvency register and your credit file will be updated accordingly. However, in a society where transgender individuals often face stigma and discrimination, this record could potentially out a person’s transgender status to anyone who accesses these records.

Impact on Spouse and Family Home

Finally, it’s essential to discuss the impact on your spouse or civil partner and your family home. Your partner isn’t responsible for your debts unless they’ve offered a guarantee or it’s a joint debt. However, bankruptcy may still affect them indirectly. For example, if your home is sold, it could lead to upheaval for your spouse or children. If your spouse jointly owns property or possessions with you, they may be sold unless your partner can buy out your share.

Bankruptcy is not a process to be undertaken lightly. Its implications go far beyond the individual debtor, affecting families and dependents too.

Motor Vehicles and Bankruptcy: Navigating the Roads of Debt

When you’re navigating the complex terrain of bankruptcy, your vehicle can present a particularly challenging aspect. A vehicle is more than a luxury; for many, it’s a lifeline, essential for work, family responsibilities, and independence. However, the rules around vehicles and bankruptcy are clear and must be adhered to.

The Effect of Bankruptcy on Vehicle Ownership

Your vehicle becomes part of the ‘bankruptcy estate’ managed by the official receiver or a trustee. They have the right to sell it to pay off your creditors.

But it’s not as black-and-white as it may seem. The insolvency practitioner will consider whether your vehicle is necessary for your employment or domestic needs (like taking children to school or relatives to medical appointments). If it is deemed necessary and the value is reasonable, you may be able to keep it.

A third party may be able to introduce funds to pay an agreed amount to the Trustee. Or, you may be required to sell your vehicle and buy a cheaper one so that funds can be realised for the benefit of the bankruptcy estate.

Finance Agreements and Bankruptcy

But what happens if your car isn’t fully paid off yet? If you have a finance agreement like hire purchase or a conditional sale agreement, the situation becomes more complicated. These agreements typically include terms that allow the finance company to end the agreement and repossess the vehicle if you become bankrupt.

If there is equity in the agreement (ie the value of the vehicle is significantly greater than the amount outstanding on the HP agreement), the official receiver or trustee might require the vehicle to be sold. Where there is no equity it will be up to the finance company to decide whether or not to repossess.

Managing Vehicle-Related Debts and Agreements

One of the first things you should do when considering bankruptcy is to discuss your situation with your finance company. They may be able to adjust your payments or terms to make it more manageable.

If you are declared bankrupt and allowed to keep your vehicle, maintaining your vehicle insurance is crucial. Bankruptcy could increase insurance costs, so make sure to shop around for the best deal.

Navigating Post-Bankruptcy Life: Repairing Your Credit Profile

One of the crucial aspects of coming out of bankruptcy is your credit profile. Bankruptcy will undoubtedly have a profound effect on it. However, the good news is that you can start the journey towards repairing it and rebuild your credit file after bankruptcy.

The Role of Bankruptcy on Your Credit Profile

When you’re declared bankrupt, this information is sent to credit reference agencies, which in turn record it on your credit file. Consequently, bankruptcy will negatively affect your credit rating. It usually stays on your file for six years or until your bankruptcy ends, whichever is later. This can make it harder to get credit or take out loans in the future.

Repairing Your Credit Score Post-Bankruptcy: What You Need to Know

After a bankruptcy discharge, repairing your credit score is a task that requires patience, consistency, and discipline. Here are a few steps to get you started on the right track:

- Check your credit file regularly: Regularly reviewing your credit file is a must. It helps you understand where you stand and keeps you informed about any changes in your credit rating. You have the right to request a copy of your credit file from any of the main credit reference agencies in the UK.

- Ensure your bankruptcy discharge is recorded: Once you’re discharged from bankruptcy, this should be reflected on your credit file. If it’s not, you may need to send a copy of your discharge certificate to the credit reference agencies.

- Start to rebuild credit slowly: One of the effective ways to rebuild your credit is to start establishing a good history of responsible credit use. This could be by using a credit builder credit card, where you spend a small amount each month and pay it off in full. Over time, this can demonstrate to lenders that you are capable of managing credit responsibly.

- Pay bills on time: Paying your bills (like utilities, rent, etc.) on time can show potential lenders that you’re reliable and can manage your finances well.

- Avoid making multiple credit applications: Each credit application you make leaves a ‘footprint’ on your credit file. Several applications in a short period may suggest to lenders that you’re reliant on credit, making you seem a higher risk.

- Consider a Notice of Correction: If there were circumstances outside of your control that contributed to your bankruptcy, such as health issues or redundancy, you could add a ‘Notice of Correction’ to your credit file. This is a 200-word statement where you can explain the reasons behind the information on your file.

Remember, the journey to improve your credit score is not a sprint; it’s a marathon. It takes time, patience, and positive, consistent financial habits. But every step you take brings you closer to financial health.

The Importance of Obtaining a Discharge Certificate

A discharge certificate is a document that legally verifies the end of your bankruptcy restrictions. Once your bankruptcy period has ended, usually after 12 months, you’re automatically discharged in most cases, even if the official receiver hasn’t completed the investigation into your affairs. You can request a letter to confirm your discharge from the official receiver, but there may be a fee for this.

Having proof of your bankruptcy discharge can be important. If a creditor claims you owe them money, your discharge certificate is your evidence that these debts have been dealt with through your bankruptcy.

Moreover, your discharge certificate plays a significant role in rebuilding your credit profile. It should be reported to the credit reference agencies, ensuring that your credit file reflects your new status.

Discharge and Its Effects on Your Belongings and Beneficial Interest

At the start of bankruptcy, your belongings (except for necessities like household items and tools for your trade) and beneficial interest in your home can be claimed by the trustee for the benefit of your creditors. However, when you’re discharged from bankruptcy, you’ll no longer have to contribute from your income towards your debts.

But what about your belongings and home? When you’re discharged, you could get your belongings back, depending on their value and whether they’ve been sold. Regarding your home, it can be a bit more complicated. If it hasn’t been dealt with within three years from the date of the bankruptcy order, the beneficial interest in your property could revert to you. However, this doesn’t happen automatically and will depend on individual circumstances. The role of the land registry and land charges in this process is essential, and obtaining legal advice is highly recommended.

Bankruptcy Timeline

Frequently Asked Questions

How does bankruptcy affect you?

Bankruptcy impacts you both financially and personally. It involves handing over control of your assets (such as property and possessions) to an insolvency practitioner who will sell them to repay your debts. Your credit rating will be negatively affected, making it difficult to borrow money in the future. The bankruptcy order will be publicly available on the Individual Insolvency Register.

How can bankruptcy happen?

Bankruptcy can occur when you’re unable to pay your debts, and you apply for a bankruptcy order. Alternatively, a creditor who’s owed £5,000 or more can apply for a bankruptcy order against you.

How can I decide whether bankruptcy is right for me?

Bankruptcy is a significant step and should be considered carefully. It’s crucial to understand all the implications, such as the potential loss of assets, impact on your credit rating, and the effect on your employment or business. Consulting with an insolvency practitioner or a legal advisor can help you evaluate if it’s the right option for you.

How can I improve my credit score?

Improving your credit score after bankruptcy takes time and consistent effort. Regularly reviewing your credit file for accuracy, paying your bills on time, and demonstrating responsible financial behaviour can gradually improve your credit score.

How can I rebuild my credit file after bankruptcy?

Rebuilding your credit file after bankruptcy involves various strategies. These include obtaining a secured credit card, keeping your credit utilisation low, and maintaining a history of on-time payments. It’s also crucial to check your credit report regularly to ensure it’s accurate and reflects your discharge from bankruptcy.

How does discharge affect your belongings?

When you’re discharged from bankruptcy, you may get your belongings back if they haven’t been sold by the trustee. However, high-value items, or those not regarded as essential, may have been sold to pay your creditors. The status of your home depends on various factors and could be more complicated.

References

The primary sources for this article are listed below.

Experian | Credit Scores, Reports & Credit Comparison

Credit Scores, Reports & History | Equifax UK

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.