Unlock the secret behind the Meaning of IVA, a debt solution, in our eye-opening guide. This revelation could transform your financial understanding and change your life! Discover this idea with the help of a knowledgeable adviser.

Introduction

In an era where personal debt in the UK is escalating at an unprecedented rate, finding viable solutions for joint debts has become a matter of utmost importance for people and companies. The economic landscape has grown increasingly complex, leaving many individuals grappling with various forms of debt, from mortgages and rent arrears to loans and credit card balances. In many cases, these burdens have spiralled out of control, becoming seemingly insurmountable obstacles that may require the expertise of an insolvency practitioner.

However, amidst the turmoil, there lies a beacon of hope for those drowning in debt. Enter the Individual Voluntary Arrangement or, as it’s more commonly known, an IVA. Often overlooked and misunderstood, this agreement presents an alternative route towards financial freedom that’s both viable and realistic for individuals struggling with arrears. With the guidance of an insolvency practitioner, this option allows individuals to address joint debts and receive expert advice on how to manage their financial situation.

The power of an IVA lies in its unique structure and purpose, tailored to provide a structured solution for debt management with the help of an insolvency practitioner. But what exactly is this elusive concept known as IVA, and how could it possibly transform your life? As you delve into this comprehensive guide, you’ll discover the transformative potential of fully understanding the meaning of IVA – a revelation that could lead you on a life-changing journey towards financial liberation. Stay with us as we unravel this secret together, and let’s begin to reimagine your financial future with the breathing space option.

Quick Links

- Unravelling the Meaning of IVA

- The Mechanics of IVA

- The Impact of IVA

- Frequently Asked Questions

- How does an IVA affect you?

- How long does an IVA last for?

- How much debt can an IVA write off?

- Can I go on holiday with an IVA?

- Is IVA debt good or bad?

- Can you get credit again after an IVA?

- How much do you pay back on an IVA?

- Can I pay my IVA off in full?

- How much debt is written off in an IVA?

- How do IVA repayments work?

- How to deal with IVA joint debts?

- References

Unravelling the Meaning of IVA

If we are to unearth the transformative potential of the Individual Voluntary Arrangement (IVA), we first need to comprehend its essence. An IVA is essentially a formal agreement made between you and your creditors, facilitated by an insolvency practitioner. It allows you, as an individual facing financial difficulties, to have a breathing space and pay back your debts over a set period, typically five to six years, often at a significantly reduced rate. But it’s not just a simple repayment plan; there’s a lot more intricacies involved that require the expertise of an insolvency practitioner.

Origins of IVA

Born out of the Insolvency Act 1986, the IVA was conceived as a more flexible and humane alternative to bankruptcy, providing the necessary breathing space to individuals overburdened with debt. The intention was not only to aid those in debt but also to ensure that creditors received a fair portion of what they were owed.

How Does IVA Work?

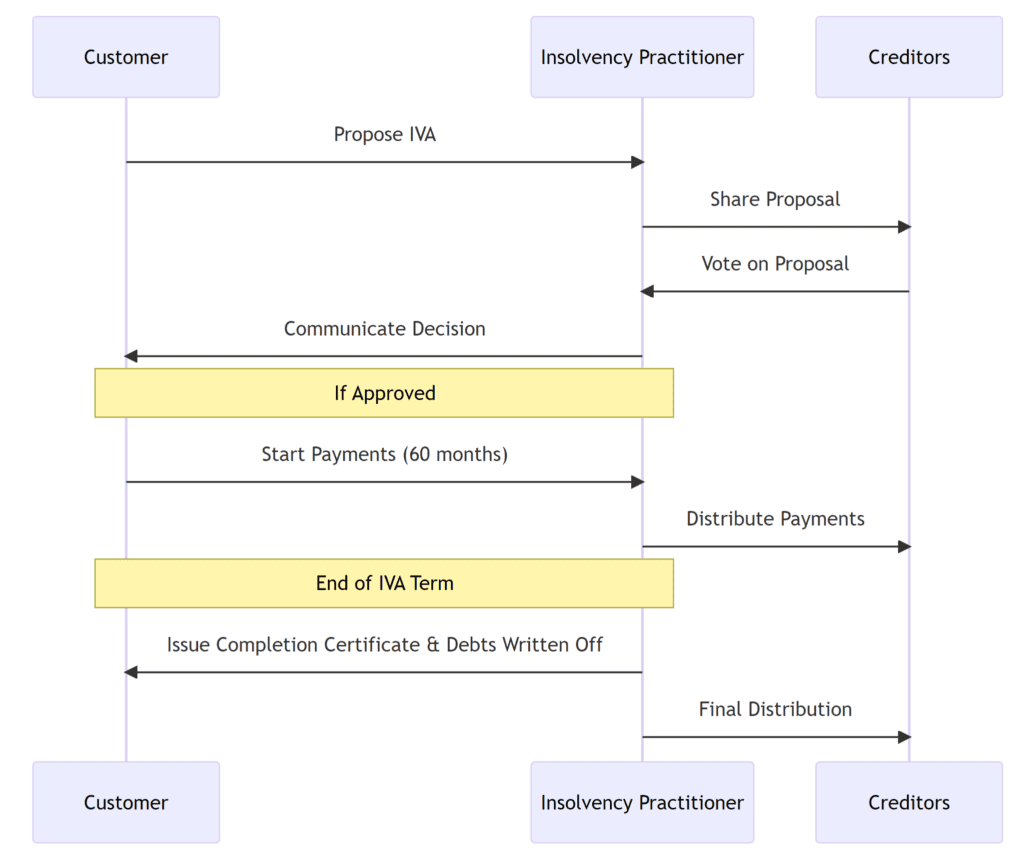

The workings of an IVA are quite straightforward once broken down. The first step involves the assistance of a qualified Insolvency Practitioner (IP), a person or company authorised by a recognised professional body to act on insolvency matters. Their role is pivotal to setting up the IVA. They’ll assess your financial circumstances, including income, assets, debts, and living costs. Based on this, they’ll create a proposal for your creditors that outlines how much you can afford to pay back over the IVA period.

Once your IVA proposal is approved by the majority of your creditors, including the insolvency practitioner, it becomes a legally binding agreement. This means that, as long as you meet the monthly payments, creditors can’t take any further action against you, nor can they add on any interest or fees to your debts.

IVA vs Other Debt Solutions

While it’s tempting to lump IVAs in with other debt solutions such as debt management companies, there are significant differences that make each suitable for unique situations. For instance, a debt management company primarily assists with managing your debts by negotiating lower interest rates or monthly payments with your creditors. However, unlike an IVA, such arrangements are informal and don’t offer legal protection from your creditors. They can, at any point, decide to change their minds about the terms or even decide to take you to court to get their money back.

On the other hand, an IVA, which is administered by an insolvency practitioner, provides a formal, legally binding structure that offers protection from creditors. Additionally, at the end of the IVA period, any outstanding debt is typically written off. This doesn’t happen with a debt management plan.

The Mechanics of IVA

Understanding the IVA process in detail is pivotal to your financial journey, and in this section, we shall thoroughly break down the mechanics of IVA, from application to completion. Alongside, we’ll provide clear definitions of key terms used in this process, including “creditor,” “fees,” “assets,” and “arrangement.”

Application and Proposal

The IVA journey starts with a simple application. You, as the debtor, must seek out an Insolvency Practitioner (IP) to assess your financial situation, including your income, assets, debts, and essential expenses. The IP then draws up an IVA proposal based on your circumstances, including details such as how much you can afford to pay, how long the IVA should last (typically five to six years), and how your assets will be treated.

Key Term: Creditor

A creditor is a person or company to whom money is owed. In the context of an IVA, creditors are those to whom the debtor owes money.

Creditors’ Meeting and Approval

The proposal is then presented to the creditors during a creditors’ meeting. The creditors will vote on the proposal, and if approved by 75% or more (in debt value), it becomes a legally binding agreement for all creditors, even those who voted against it or didn’t vote at all.

Commencement of IVA

With the IVA approved, the debtor must make regular payments, typically monthly, to the IP. These payments are then distributed among the creditors.

Key Term: Fees

Fees in an IVA context refer to the charges an IP levies for their services. These are typically taken from the monthly payments you make into the IVA.

Completion of IVA

At the end of the IVA period, assuming all payments have been made, any remaining debt included in the IVA is written off. The IP will then issue a certificate of completion.

Key Term: Assets

Assets are property owned by an individual or company. In an IVA, assets can include anything from your home and vehicles to savings and investments. Depending on your IVA agreement, you may be required to revalue and release equity from your assets, such as your house.

Key Term: Arrangement

An arrangement in the context of an IVA refers to the agreement set up between the debtor and the creditors, outlining the repayment terms of the debtor’s outstanding debts.

Flow Chart Showing IVA Process

The Impact of IVA

Having an understanding of the meaning of IVA also involves knowing how it can impact various aspects of your personal life. These impacts can be significantly noticed on your housing situation, income, and loans.

Your Housing Situation and IVA

Whether you are a renter or homeowner, entering into an IVA could influence your living situation.

Renters: In the realm of renting, an IVA usually doesn’t directly impact your lease agreement. However, it’s important to be transparent with your landlord about your financial situation, as some rental contracts might have clauses relating to insolvency.

Homeowners: For homeowners, your mortgage will not be included in the IVA, meaning regular mortgage payments need to be maintained. However, if you have equity in your home, you may be asked to release it to contribute to your IVA. If remortgaging isn’t possible, your IVA may be extended for 12 months.

Income and IVA

An IVA is tailored to your individual circumstances, which means your income plays a crucial role. The voluntary arrangement is structured around your disposable income – the money you have left after essential bills and living costs. This is divided into manageable monthly payments towards your debts.

Any additional income during the IVA period – like a work bonus or increase in salary – may need to be added to your IVA contributions, ensuring your creditors receive as much of the money owed to them as possible.

Loans and IVA

Regarding loans, they become a part of the IVA arrangement. This means that instead of paying separate creditors, you make one monthly payment towards your IVA, which gets distributed amongst your creditors. This simplifies the payment process, and in some cases, can significantly reduce the total amount to be repaid.

Here’s a table showing potential scenarios:

| Situation | Without IVA | With IVA |

|---|---|---|

| Renting | Potential eviction if unable to pay rent | Rent not directly affected, regular payments to be maintained |

| Homeownership | Risk of losing home due to unmanaged debts | Regular mortgage payments to be maintained, possible equity release |

| Income | All income used to repay debts | Structured monthly payments, additional income may increase contribution |

| Loans | Multiple payments to different creditors | One monthly payment distributed to creditors |

An IVA, being a legally binding agreement, offers certain protections to the individual. It creates a space where creditors can’t take further action to recover the debt and provides a ‘breathing space’ from worrying about numerous debt repayments. However, it’s essential to be aware that your name and details will appear on the public Insolvency Register, and your credit rating will be impacted during the IVA and for some years after completion.

The adoption of an IVA is a decision that should not be taken lightly. Always seek advice from a professional adviser before entering an arrangement. The more you understand the meaning of IVA, the better you can navigate its potential impacts and determine whether it’s the right solution for your circumstances.

Frequently Asked Questions

In order to further your understanding of the meaning of IVA, it’s beneficial to explore some commonly asked questions surrounding the subject.

How does an IVA affect you?

An IVA can significantly affect your life both during its term and afterwards. During the term, an IVA allows you to consolidate your unsecured debts into one affordable monthly payment. It protects you from legal action by your creditors, provides a ‘breathing space’ for you financially, and often writes off a portion of your debts. However, it will also affect your credit rating for six years from the start date, and your details will be listed on the public Insolvency Register.

How long does an IVA last for?

Typically, an IVA lasts for a period of five years (60 months), but it can be extended if necessary. In some cases, if you are able to offer a lump sum payment, the term may be shorter.

How much debt can an IVA write off?

The amount of debt that can be written off with an IVA varies greatly and depends on your individual financial situation. It could be as much as 60-81% of your unsecured debt, but the actual percentage will depend on your income, expenditure, and total debt level.

Can I go on holiday with an IVA?

Yes, you can go on holiday while on an IVA, but it’s important to note that all expenditures need to be within the agreed budget set out in your IVA. Luxury holidays may not be a feasible option unless funded by third parties or savings that do not affect your monthly IVA payments.

Is IVA debt good or bad?

Like any form of debt solution, an IVA comes with its pros and cons. On the one hand, it can provide a structured, manageable way to pay off your debts and offers legal protection from creditors. On the other hand, it impacts your credit score, restricts your ability to borrow during the term, and requires a strict budgeting discipline.

Can you get credit again after an IVA?

You can get credit again once your IVA is complete and removed from your credit report. This typically happens six years from the start date of your IVA. However, each lender has their own criteria, and some might ask if you’ve ever been in an IVA.

How much do you pay back on an IVA?

The amount you repay on an IVA is based on your disposable income, and is typically paid in monthly instalments over the course of the IVA period. This is calculated by subtracting your living costs from your total income.

Can I pay my IVA off in full?

Yes, if your circumstances change and you find yourself with a lump sum of money – such as from a redundancy payment, inheritance or lottery win – you may be able to settle your IVA early.

How much debt is written off in an IVA?

The amount of debt written off in an IVA is dependent on several factors, including the total amount of debt, your income, and your expenditure. The remaining balance of the included debts after the IVA term is usually written off.

How do IVA repayments work?

IVA repayments are based on your disposable income. You’ll pay a single, affordable monthly payment, which is distributed to your creditors on a pro-rata basis by your Insolvency Practitioner.

How to deal with IVA joint debts?

Joint debts can be included in an IVA, but both parties are still responsible for the full amount of the debt. If one party enters into an IVA, the other party could still be pursued for the remaining balance.

Remember, understanding the meaning of IVA and the implications it has on your life is a significant step towards improving your financial health. Consult with a professional adviser to ensure that you are making the best decision for your circumstances.

References

The primary sources for this article are listed below.

Insolvency Act 1986 (legislation.gov.uk)

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.