In the complex world of finance, debt is an aspect that many of us grapple with. It’s not uncommon to find ourselves dealing with debt collectors, and one name that might crop up is Debt Managers Ltd. This article serves as a comprehensive guide for individuals who have found a letter from Debt Managers Ltd in their post or have been contacted by them.

We’ll delve into who Debt Managers Ltd are, their legitimacy as a debt collection agency, and crucially, how you can halt their debt collection activities instantly and for free. We understand that dealing with debt can be stressful, and it’s easy to feel overwhelmed.

So, whether you’re looking for advice on dealing with Debt Managers Ltd or seeking a way out of your debt situation, this guide is here to help. Let’s get started.

Quick Links

Who are Debt Managers Ltd?

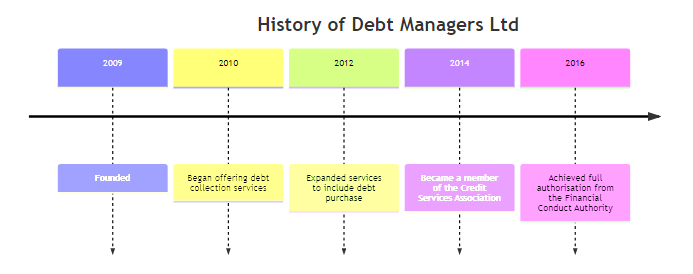

Debt Managers Ltd, often referred to as Debt Managers Services Ltd, is a debt collection agency based in the UK. Established in 2009, they have over a decade of experience in the field of debt collection and recovery.

The company offers a range of services, primarily focusing on the collection of outstanding debts. They work on behalf of various businesses, including banks, credit card companies, and utility providers, to recover money owed by customers.

In 2012, Debt Managers Ltd expanded their services to include debt purchase. This means they buy debts from original creditors, often at a reduced price, and then attempt to collect the full debt amount from the debtor, thus making a profit.

Debt Managers Ltd is a member of the Credit Services Association (CSA), the UK’s national trade association for companies active in the debt collection and purchase industry. They achieved this status in 2014, further cementing their place in the industry.

In 2016, Debt Managers Ltd received full authorisation from the Financial Conduct Authority (FCA), the regulatory body for financial firms providing services to consumers. This authorisation is a testament to their adherence to the strict guidelines and standards set by the FCA.

While Debt Managers Ltd may seem like just another debt collection agency, it’s important to understand how they operate and what your rights are when dealing with them. In the following sections, we will delve deeper into these aspects.

The Legitimacy of Debt Managers Ltd

When dealing with debt collectors, it’s crucial to ascertain their legitimacy. Debt Managers Ltd is indeed a legitimate debt collection agency. They are registered in England and Wales under company number 06784783. Their registered office is located at 2 Apex View, Leeds, West Yorkshire, LS11 9BH.

As mentioned earlier, Debt Managers Ltd is fully authorised by the Financial Conduct Authority (FCA). The FCA is the regulatory body for financial firms in the UK, and their authorisation carries significant weight. It means that Debt Managers Ltd has met the stringent criteria set by the FCA and operates within the rules and regulations laid out by this authority. Their FCA registration number is 718645, and this can be verified on the FCA’s Financial Services Register.

Debt Managers Ltd is also a member of the Credit Services Association (CSA), the national association in the UK for companies active in the debt recovery, debt purchase and credit industry. Membership in the CSA further underscores their legitimacy as it requires adherence to a code of practice that promotes best practice within the industry.

However, it’s important to note that while Debt Managers Ltd is a legitimate company, this doesn’t necessarily mean that their practices are always fair or ethical. There have been instances where debt collection agencies, including Debt Managers Ltd, have been reported for using aggressive or intimidating tactics to recover debts. These tactics can include frequent and intrusive phone calls, threatening letters, and even home visits.

The FCA has guidelines in place to protect consumers from such practices. These guidelines stipulate that a debt collector should treat debtors with fairness, respect their privacy, and provide clear information about the debt and their rights. They should also take into account a debtor’s circumstances and ability to pay when attempting to recover the debt.

If you believe that Debt Managers Ltd is not adhering to these guidelines, you have the right to lodge a complaint with the Financial Ombudsman Service. This is a free and independent service for settling disputes between financial businesses and their customers.

How to Stop Debt Managers Ltd Collection Activities

If you’ve received a letter from Debt Managers Ltd and are feeling overwhelmed, it’s important to know that you have rights and options. Here’s a step-by-step guide on how to halt Debt Managers Ltd’s debt collection activities:

Step 1: Assess Your Financial Situation

Before you respond to Debt Managers Ltd, take a moment to assess your financial situation. Can you afford to pay the debt? If you can, it may be best to pay the debt in full or negotiate a payment plan with Debt Managers Ltd. This can help you avoid further collection activities and potential damage to your credit score.

Step 2: Validate the Debt

If you can’t afford to pay the debt or if you don’t recognise the debt, it’s crucial to validate it. Under the Consumer Credit Act, you have the right to request Debt Managers Ltd to provide detailed information about the debt, including the original creditor and the amount owed. If they fail to provide this information or if the information is incorrect, you can dispute the debt.

Step 3: Seek Advice

If the debt is valid but you can’t afford to pay it, it’s advisable to seek advice from a debt advisor. We can provide free and impartial advice. They can help you understand your options, which may include setting up an Individual Voluntary Arrangement (IVA).

Step 4: Dispute the Debt

If Debt Managers Ltd fails to validate the debt or if you believe the debt is not yours, you can dispute it. Write to Debt Managers Ltd explaining why you dispute the debt and ask them to stop collection activities until the dispute is resolved.

Step 5: Escalate to the Financial Ombudsman Service

If your dispute with Debt Managers Ltd is not resolved to your satisfaction, you can escalate it to the Financial Ombudsman Service. The Financial Ombudsman Service is an independent body that settles disputes between consumers and financial businesses. They can investigate your complaint and, if they find in your favour, they can order Debt Managers Ltd to put things right.

Remember, it’s important to act quickly if you receive a letter from Debt Managers Ltd. Ignoring the problem won’t make it go away and could lead to further action, such as a County Court Judgement (CCJ) or even bailiffs.

Become Debt Free: Your Ally Against Debt

In the face of mounting debts and relentless collection activities, it’s easy to feel alone and overwhelmed. But remember, you don’t have to navigate these choppy financial waters by yourself. Become Debt Free, a licensed insolvency practitioner based in Leeds, is here to be your ally against debt.

Who is Become Debt Free?

Become Debt Free is a team of dedicated professionals committed to providing advice and solutions to individuals struggling with debts. We understand that every person’s financial situation is unique, and we tailor our services to meet your specific needs. Our goal is to help you regain control of your finances and work towards a future free from the burden of debt.

What Services Does Become Debt Free Offer?

At Become Debt Free, we offer a range of services designed to help you manage and reduce your debts. One of our key specialities is Individual Voluntary Arrangements (IVAs). An IVA is a formal agreement between you and your creditors that allows you to pay back a portion of your debts over a set period, usually five years. At the end of this period, any remaining debt is written off.

IVAs can be an effective way to manage significant debts, stop collection activities, and avoid more drastic measures like bankruptcy. However, they’re not suitable for everyone. That’s why our team will take the time to understand your financial situation and explore all available options with you.

How Can Become Debt Free Help You?

If you’re dealing with debt collectors like Debt Managers Ltd, Become Debt Free can provide the support and guidance you need. We can help you understand your rights, validate your debts, and explore potential solutions. If an IVA is right for you, we can manage the process from start to finish, dealing with your creditors on your behalf.

Remember, dealing with debt is not a journey you have to make alone. Become Debt Free is here to help. If you’re struggling with debts, don’t hesitate to reach out to us. You can call us on 0800 169 1536 or leave an enquiry on our website. Let’s work together towards a debt-free future.

In the next section, we’ll answer some frequently asked questions about Debt Managers Ltd and how to deal with them.

Frequently Asked Questions

In this section, we’ll answer some of the most common questions people have about Debt Managers Ltd, debt collection, and debt management solutions.

What should I do if I receive a letter from Debt Managers Ltd?

If you receive a letter from Debt Managers Ltd, don’t ignore it. It’s important to confirm whether the debt is yours. If you don’t recognise the debt, you have the right to request proof. If the debt is yours, consider seeking advice from a debt management company like Become Debt Free to explore your options.

Can Debt Managers Ltd take me to court?

Yes, if you owe a debt and fail to pay it, Debt Managers Ltd can apply for a County Court Judgement (CCJ) against you. This is a serious matter and can negatively impact your credit score. If you’re facing this situation, it’s crucial to seek professional advice.

What is an IVA and how can it help me?

An Individual Voluntary Arrangement (IVA) is a formal agreement between you and your creditors. It allows you to pay back a portion of your debts over a set period, usually five years. At the end of this period, any remaining debt is written off. An IVA can help you regain control of your finances and stop collection activities.

How can Become Debt Free help me deal with Debt Managers Ltd?

Become Debt Free can provide advice and solutions to help you manage your debts. We can help you understand your rights, validate your debts, and explore potential solutions like IVAs. If an IVA is right for you, we can manage the process from start to finish, dealing with your creditors on your behalf.

Can I stop Debt Managers Ltd from contacting me?

Yes, you can request that Debt Managers Ltd stop contacting you. However, this won’t make the debt go away. It’s important to deal with the debt, either by paying it off or seeking a debt management solution.

Remember, if you’re struggling with debt, you don’t have to face it alone. Become Debt Free is here to help. Contact us on 0800 169 1536 or leave an enquiry on our website.

Conclusion

In this guide, we’ve taken a close look at Debt Managers Ltd, a debt collection agency that may have contacted you about outstanding debts. We’ve explored their legitimacy and discussed how you can halt their collection activities. Importantly, we’ve also introduced you to Become Debt Free, a licensed insolvency practitioner based in Leeds, who can provide advice and solutions to individuals struggling with debt.

Dealing with debt can be stressful and overwhelming, but remember, you have rights and options. Whether it’s questioning the validity of a debt, understanding the guidelines set by the Financial Conduct Authority, or exploring debt management solutions like IVAs, you have the power to take control of your financial situation.

Don’t let the fear of debt control your life. Reach out to professionals who can provide the help and guidance you need. Become Debt Free specialises in IVAs and offers advice tailored to your unique circumstances. Our goal is to help you navigate your financial challenges and move towards a future free from the burden of debt.

If you’re ready to take the first step towards becoming debt free, we’re here to help. Contact us on 0800 169 1536 or leave an enquiry on our website. Let’s tackle your debts together and help you regain control of your financial future.

Debt Managers Contact Information

Telephone Number: 03330 037 724

Website: https://www.debt-managers.com/

Registered Office: Yorke House, Arleston Way, Solihull, B90 4LH

Registration Number: 8092808

Registered in England and Wales

Authorised and Regulated by the Financial Conduct Authority for accounts formed under the Consumer Credit Act 1974 (amended 2006)

Our registration number is 661939.

References

The primary sources for this article are listed below.

Debt Managers (debt-managers.com)

Financial Conduct Authority | FCA

Details of our standards for producing accurate, unbiased content can be found in our editorial policy here.