The effect of debt on children. According to The Money Charity1, people in the UK owed £1,692 billion by the end of November 2020. This is £21.6bn more than the previous year and an extra £408 per adult. The Covid-19 crisis has pushed even more families in debt – the loss of jobs, school closures and bigger bills have forced millions of families on the lower income to take even more debt to pay for essentials.

It is estimated2 that once the furlough scheme ends, more than 2.6 million people could be unemployed in the UK, leaving them struggling to pay for essentials such as food, bills and housing. This is bad news for the youngest too, as this means that the number of children living in poverty is estimated to reach 5 million this year3.

How debt affects children

Debt is a major cause of anxiety and stress amongst families and affects parents, as well as children.

Poverty and debt can have a serious impact on a child’s mental health, their relationship with their peers and leave them feeling isolated, unworthy or ashamed. These emotions can have serious, long term effects on a child’s mental health. Sometimes children would feel left behind if they don’t have the same gadgets and toys as their peers or in the worst situations, children would feel like they go without basics like good school uniform and even food. As a result, children affected by debt and poverty may fall behind in school, struggle with concentration and refuse to attend classes.

Research by The Money Advice Service found that “…children growing up in families in problem debt are five times more likely to be unhappy than those in families without debt troubles.” It is crucial for parents to take control of their debt and prevent child depression, anxiety, poor performance at school and negative emotions which affect their child’s wellbeing. So what can parents do to tackle their debt and help their children have a happy, debt-free childhood?

Asses your debts, current financial situation and how it affects your children

Firstly assess your income and expenditure – try to cut costs where possible and make sure you claim all benefits you are eligible for. If you have been affected by Coronavirus, you may be eligible for extra financial help.

Sort your debts by priority. Priority debts are those that carry the most serious consequences if you don’t pay them, they don’t have to be the largest or debts with the most expensive interest rates, but if you don’t pay them it could lead to serious problems. We can help you write off up to 90% of your priority and non-priority unsecured debts. Get in touch with our team for a private and friendly chat.

Priority debts include mortgage and rent arrears, council tax debt, court fines, utility bills and income tax arrears. The consequences of missing payments on priority debts can lead to bailiff visits, having heating and electricity being cut off and even evictions.

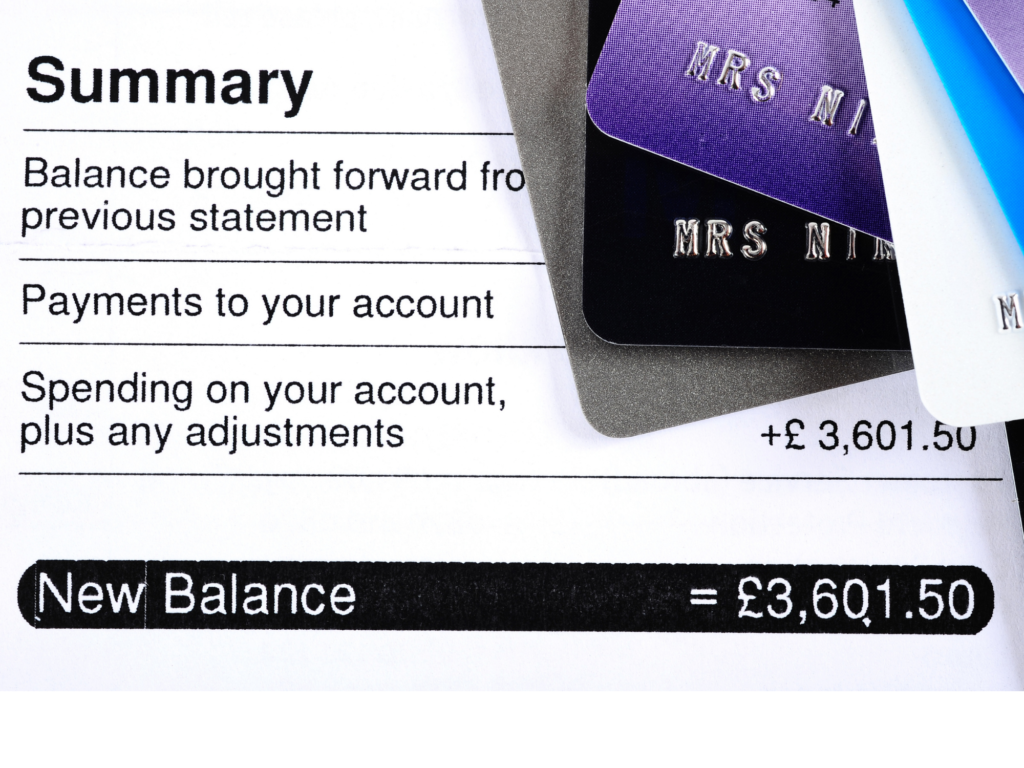

Non-priority debts include overdrafts, personal loans, banks or building society loans, money borrowed from friends or family, credit cards, store card debts or payday loans. Non-priority debts are still important to dealt with, as interest and charges will cause your debt to grow.

The above mentioned consequence of not dealing with priority debt will most likely leave a lasting trauma in any child and immediately impact their learning abilities, behaviour and their current and long term mental health.

The effect of debt on children varies depending on individual circumstances, however many children and young adults may feel guilt or helplessness when their families struggle with debt. Remain calm while speaking to your child and reassure them that your finances are not their fault and they should not feel guilty. You may have to speak to your child about your financial situation and explain why they may no longer be able to participate in activities such as swimming lessons, school trips or go on holidays.

Speak to your creditors and Become Debt Free

If you find yourself struggling with unaffordable debts, you don’t have to deal with this alone. Speak to our Become Debt Free advisors or get in touch your creditors. Our team will help you find the best solution for your situation, while creditors may be willing to give you a payment holiday.

The most suitable debt solution would depend on your employment status, income and other eligibility criteria. Get in touch with our team for a friendly, confidential chat.

What are debt management solutions are there?

An IVA (individual voluntary arrangement) is a formal legally binding agreement between you and your creditors. It is designed to help you deal with your debts through affordable monthly payments. An IVA is by far the most preferred choice over other options such as bankruptcy and debt relief orders. Over 78,000 IVA’s were taken out last year representing about 63% of all insolvencies.

Popular for those looking to control unmanageable sums, it freezes interest and creates a repayment plan over a set period. This also means that direct contact with creditors ceases while the IVA is active. Finally, when the arrangement comes to an end, any unrepaid debt is written off.

Debt Management Plan. Your payments are proposed based on what you can reasonably afford. This is worked out through a breakdown of your monthly income and expenditure. The payments are usually paid over a longer period. Payments can also be revised should your circumstances change.

Unlike an IVA, you will repay your debt in full. Your creditors may agree to freeze interest and fees on the debts included, but this is not guaranteed. If you opt for a private debt management company, they will charge you a fee for negotiating and administering your DMP. However, there are some debt charities that offer the service for free.

Additional Debt Solutions. As well as the options mentioned above, there are alternatives which might be suitable. From debt relief orders to bankruptcy, these could help you on the path to financial freedom.

Lead by example

Parents are considered to be the number-one influence on their kids’ money habits and behaviours, which can help their future financial wellbeing. How parents spend and talk about money is as equally important as teaching children healthy money habits, such as budgeting their allowance.

While parents may lose control of their financial situation at times, it is important to try and prevent debt from affecting children’s mental health, learning abilities and relationships with their peers. Let your children see you weighing your spending decisions, delaying purchases you cannot afford, saving and tackling unaffordable debts.

Sources

https://themoneycharity.org.uk/money-statistics/

https://www.bbc.co.uk/news/business-52660591

https://www.childrenssociety.org.uk/what-we-do/our-work/ending-child-poverty